- Howie Town

- Posts

- Momentum Monday - Looking for Trends Without Friends as Bull Market Continues

Momentum Monday - Looking for Trends Without Friends as Bull Market Continues

As a reminder, MarketSurge (by Investor’s Business Daily) is now a sponsor of the weekly show. All the charts you have been seeing in the videos and will continue to see are from MarketSurge. They are offering my readers 2 months for $59.95 - save $239. That's 80% off the most powerful stock research platform for individual investors.

Good morning…

This is truly a market of stocks right now.

There is silly froth as people chase story stocks.

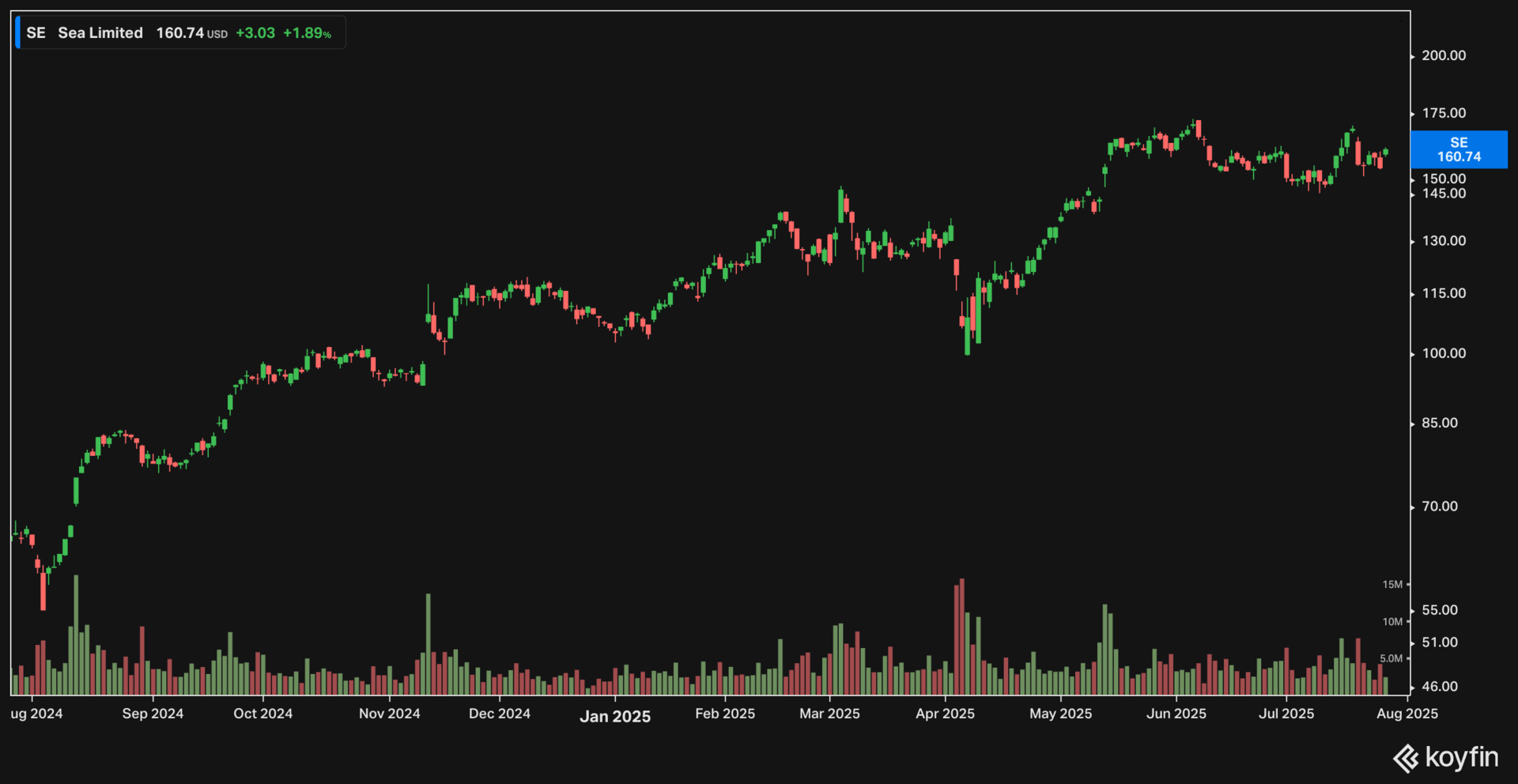

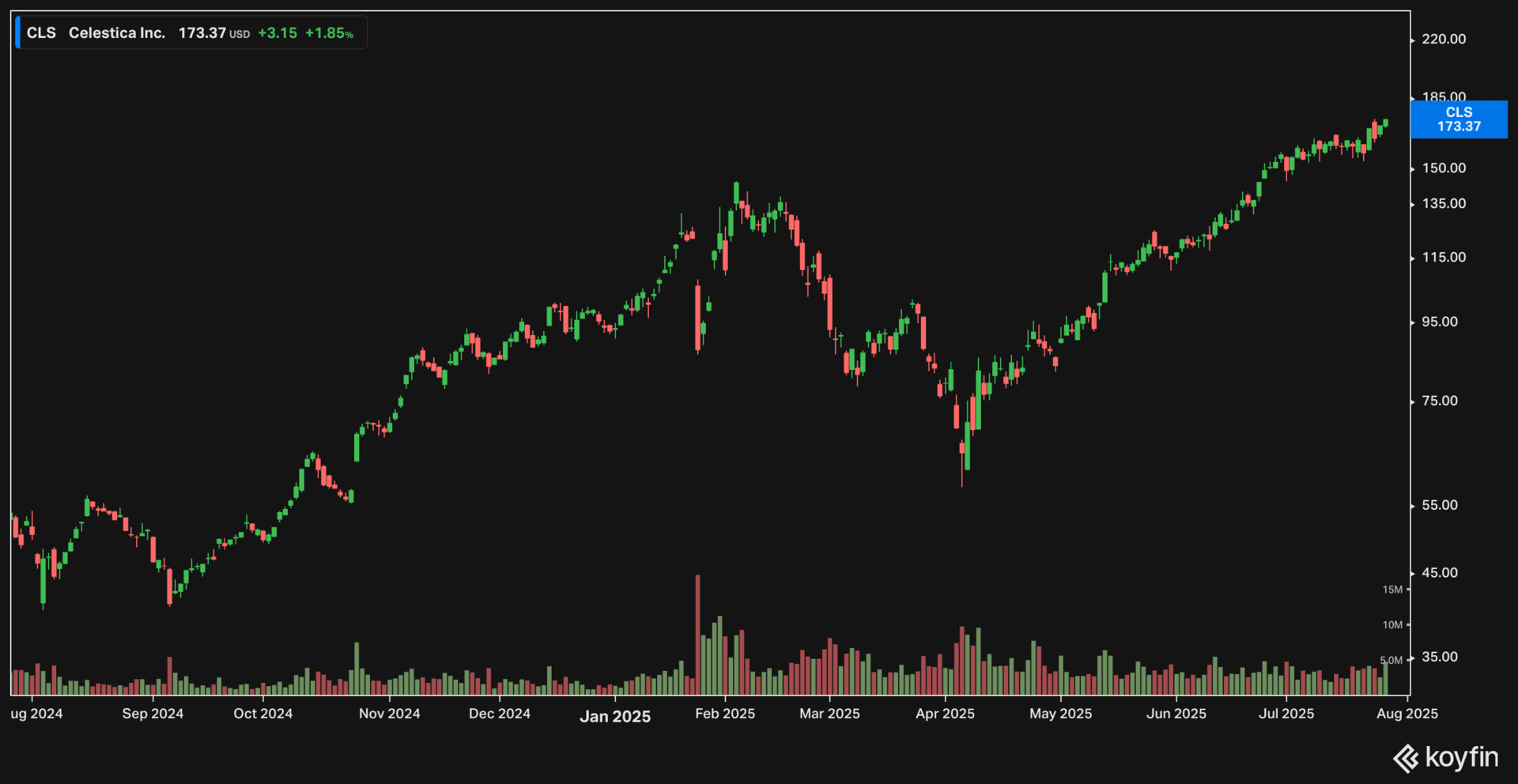

There are incredible trends in $10-$20 billion AI related businesses that few on Stocktwits follow - $CLS ( ▼ 6.34% ) comes to mind. These are my favorite type of stocks which I call ‘trends with no friends’. They have high price relative strength and low soaicl followings/low awareness.

There are also beaten up ‘fallen angel’ stocks like $LULU ( ▲ 1.14% ) and $LVMH ( 0.0% ) that are trading at their lowest multiples in years.

I stick to upward momentum trends , but i’m keeping an eye on beaten down names for a turn.

This week Ivanhoff and I cover this all and some fresh ideas as always.

Welcome back to Momentum Monday!

In today’s episode of Momentum Monday, Ivanhoff and I discuss the following:

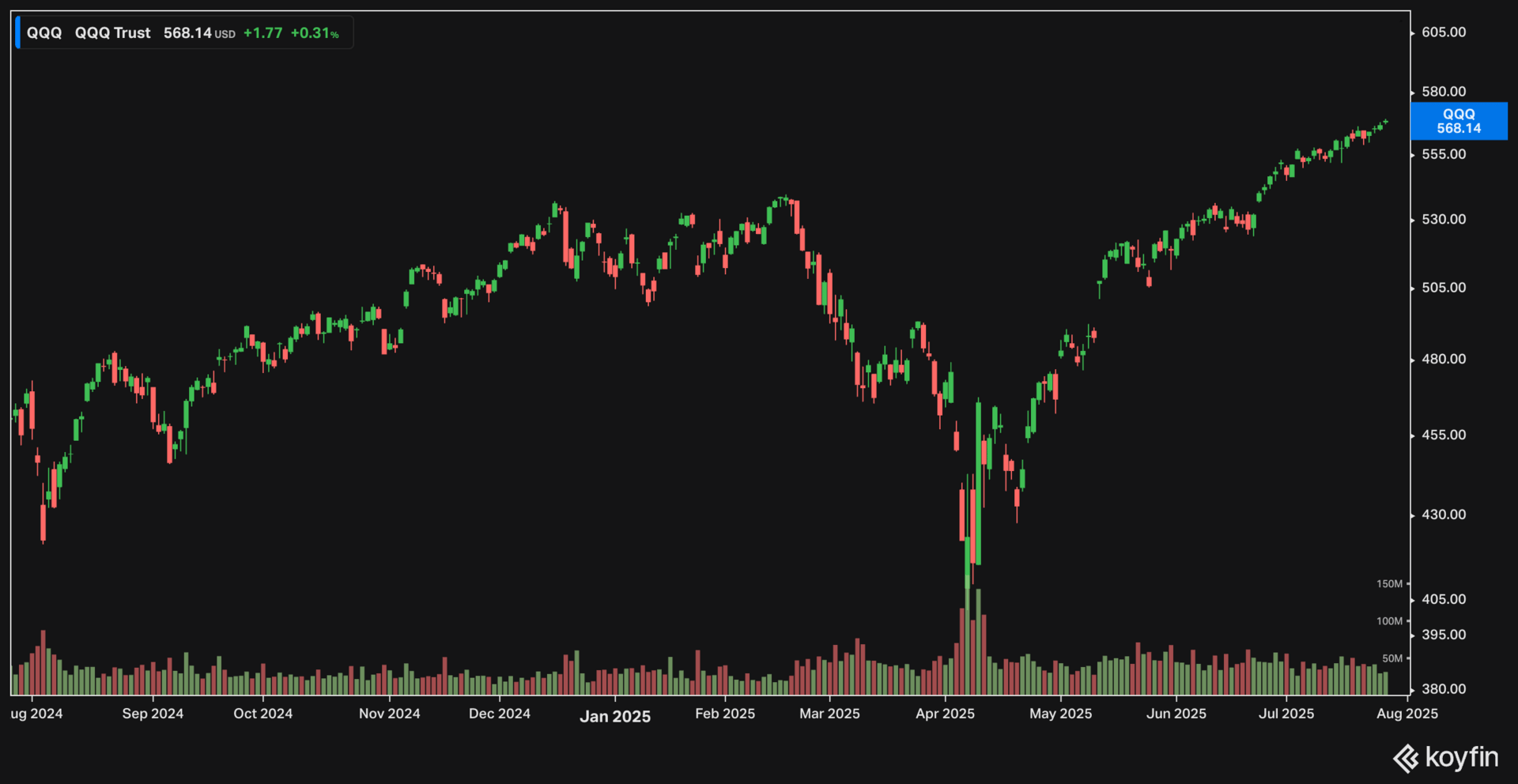

Analyzing NASDAQ 100 at All-Time Highs

Market Trends: Fallen Angels and Luxury Stocks

Understanding Market Pullbacks and Sector Rotation

Rising Costs and Anxiety in the Economy

Market Reactions to Trade Deals

Unstoppable Growth: $RBLX ( ▼ 13.17% ) and Gaming Monetization

In This Episode, We Cover:

Analyzing NASDAQ 100 at All-Time Highs (0:00)

Market Trends: Fallen Angels and Luxury Stocks (4:11)

Understanding Market Pullbacks and Sector Rotation (8:27)

Rising Costs and Anxiety in the Economy (12:04)

Market Reactions to Trade Deals (15:39)

Unstoppable Growth: $RBLX ( ▼ 13.17% ) and Gaming Monetization (19:30)

Here are Ivanhoff’s thoughts:

The S&P 500 and the Nasdaq 100 keep making new all-time highs on almost a weekly basis lately. The dips are shallow and don’t last long. Naturally, the price action in the indexes differs significantly from the action in momentum individual stocks, which are a lot more volatile. We saw it again last week, when stocks like PLTR and HOOD had 6-10% pullbacks while the indexes barely moved. The pullback in many momentum stocks earlier last week coincided with a rally in lagging sectors like homebuilders. This is not the first time we have seen such rotations. The month of July started in a similar manner. So far, the pullbacks in momentum stocks haven’t led to a substantial correction; they just offered better risk-to-reward entry points. Sector rotations and dip buying are among the two most prominent bull market characteristics.

We are at the beginning of a new earnings season. We should be talking about earnings surprises and unusual market reactions, but this is not what the market is really focused on. Two other elements seem to have a bigger impact on sentiment – tariffs and interest rates.

The Fed is meeting again this week. The expectations are for no change of the current path – meaning rates stay the same and there’s a consideration for a cut later in the year. And yet, the Fed might surprise us. There has been a lot of political pressure lately for lower rates. Any hint of rate cuts from the Fed will likely lead to a rally in the more interest-rate-sensitive groups in the market, such as homebuilders and biotech companies.

You might think that tariffs don’t matter and have been priced in already, but this is not what we saw in the market reactions to trade deals. They lead to significant gaps – see Japanese stocks last week. Vietnam ETF, VNM, is up 20% since the announcement of a deal on July 2nd. We are likely to see more announcements next week as the next deadline, August 1st, is approaching.

Reply