- Howie Town

- Posts

- Momentum Monday - What If NO Rate Cut?

Momentum Monday - What If NO Rate Cut?

As a reminder, MarketSurge (by Investor’s Business Daily) is now a sponsor of the weekly show. All the charts you have been seeing in the videos and will continue to see are from MarketSurge. They are offering my readers 2 months for $59.95 - save $239. That's 80% off the most powerful stock research platform for individual investors.

Good morning…

As always, Ivanhoff and I got together last night to go trough the markets looking for the momentum and trends. You can watch the video below or on YouTube directly.

I am reading this morning that there is only a 42 percent of a rate cut. I don’t follow the news closely but I follow prices and it seems like others in the FED might be agreeing with me in what I see with my own two eyes…inflation. If the FED does not cut rates, investors won’t be shocked, but traders will zero in on the ‘why’ immediately. So the notes will tell all.

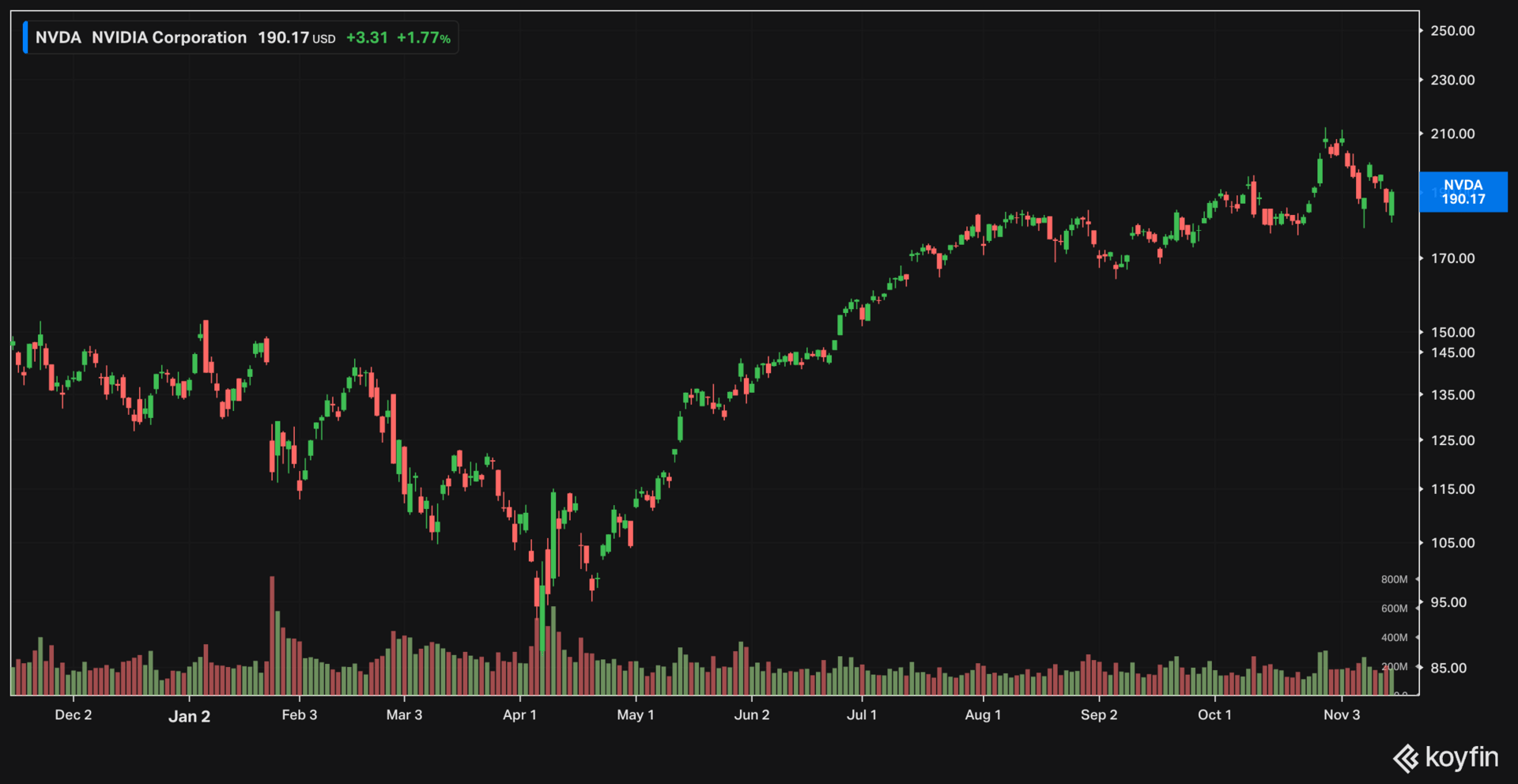

Nvidia also reports this week and few expect anything but a great quarter.

The Economist, on the other hand sees the world crashing…

From my viewpoint, it might be the economy that finally topples this market…not the markets crashing the economy.

The bearish Economist cover does not worry me.

What worries me is the randomness of the economic policies and the mean tone that comes from the top directly at Americans. If you can’t get a meet with the President or insiders like energy and technology leaders seem to be able to do, you are alone to figure things out as you read the random and hectic news straight from Trump’s fingers.

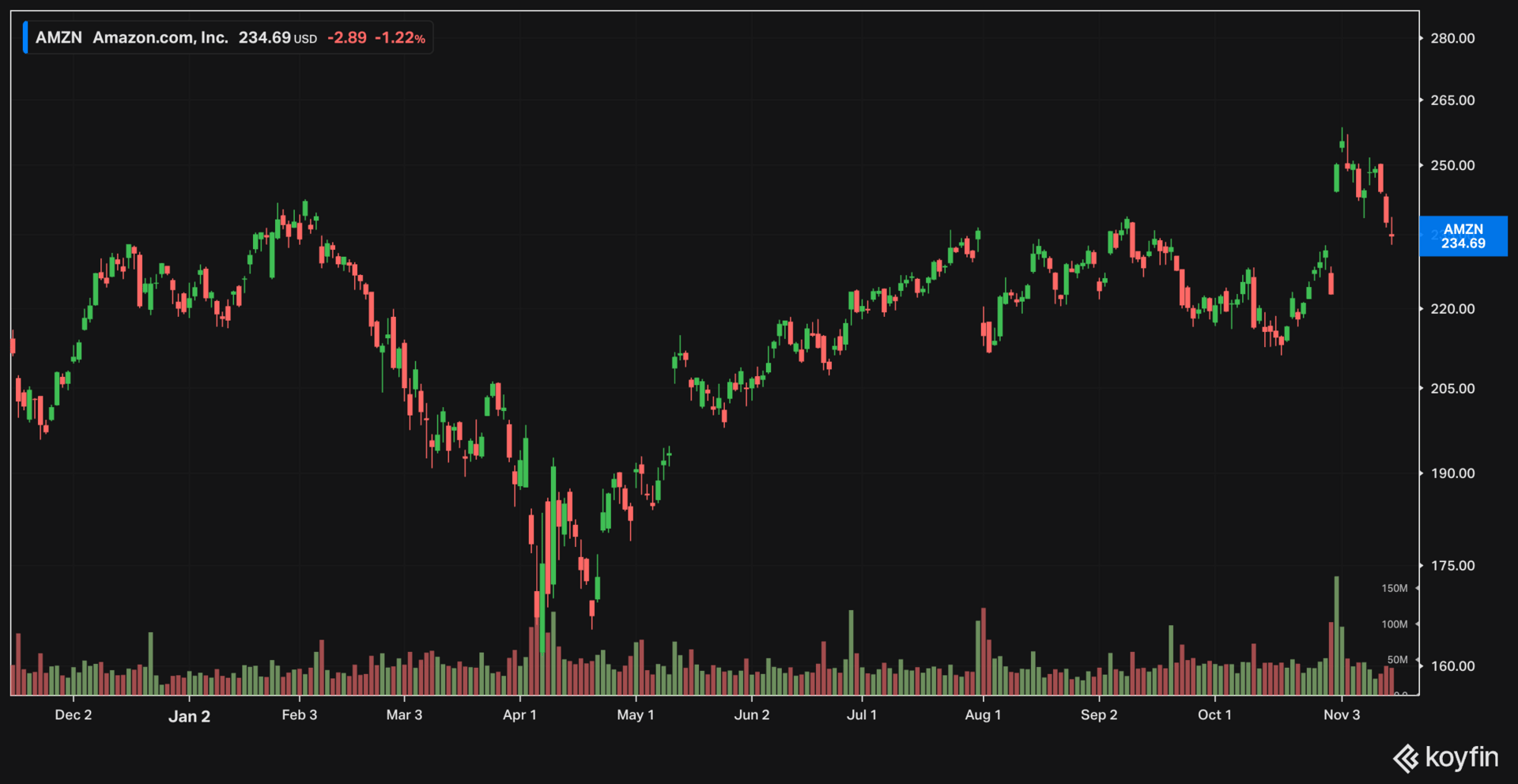

The good news is that money is not coming OUT of the markets, it continues to rotate.

Peter Thiel sold all his Nvidia and some Tesla, but bought Apple and Microsoft.

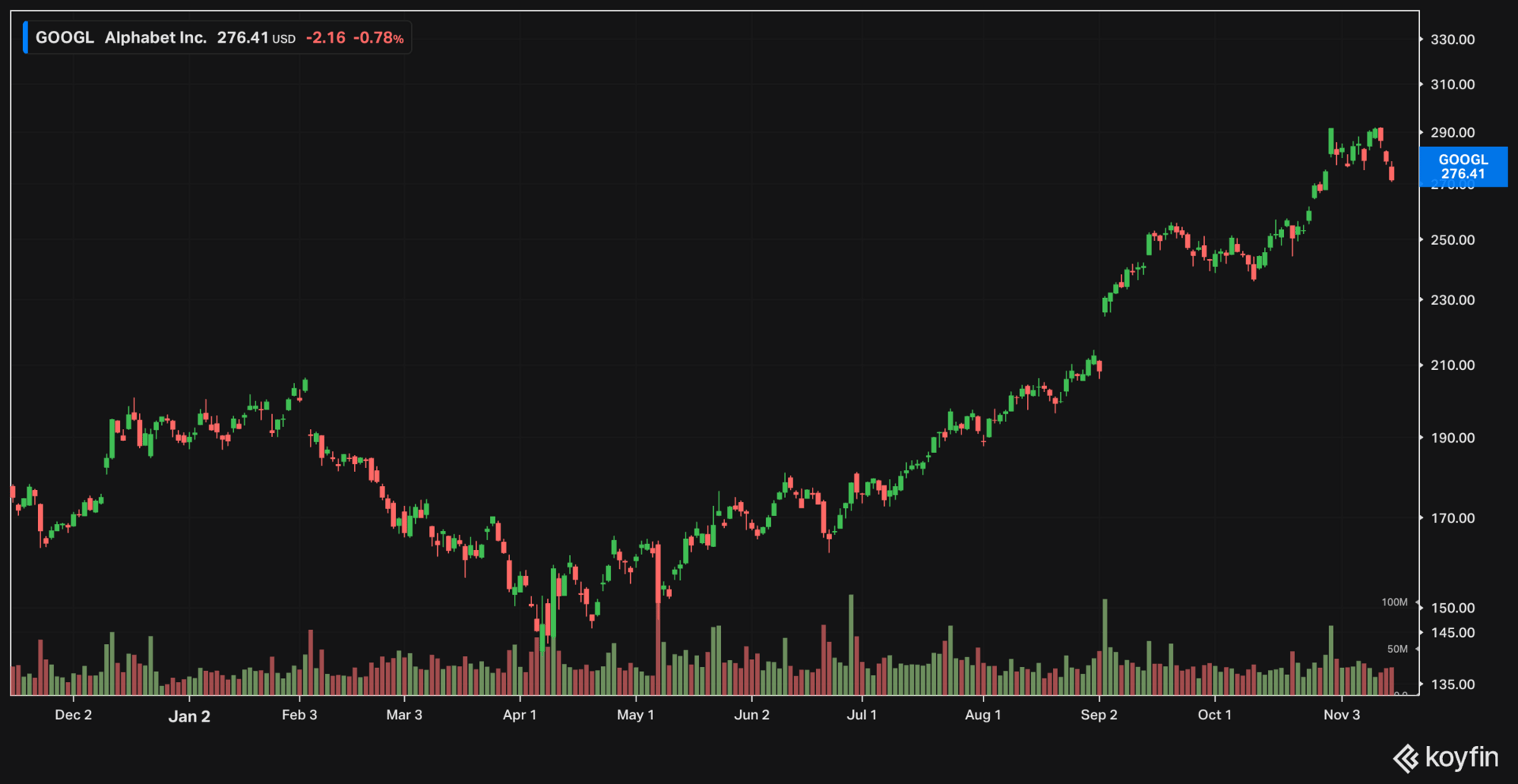

Warren bought Google.

The big money is still finding stocks to buy, not leaving the market.

Enjoy the show…

Welcome back to Momentum Monday!

In today’s episode of Momentum Monday, Ivanhoff and I discuss the following:

Market Pullback & Big Tech Overview

Rotation Into Utilities, AI & Retail

Challenging Tech Valuations & Risks

Sector Rotation: Biotech, Energy & Solar

Momentum Trades & Stock Setups

Market Volatility, Policy Risk & Final Thoughts

In This Episode, We Cover:

Here are Ivanhoff’s thoughts:

When a bull market has been going for a long time and dips have been bought regularly, a trader might become complacent and delude himself into thinking that this will continue forever. At some point, things will change – first quietly and gradually, and then loudly and “all of a sudden”.

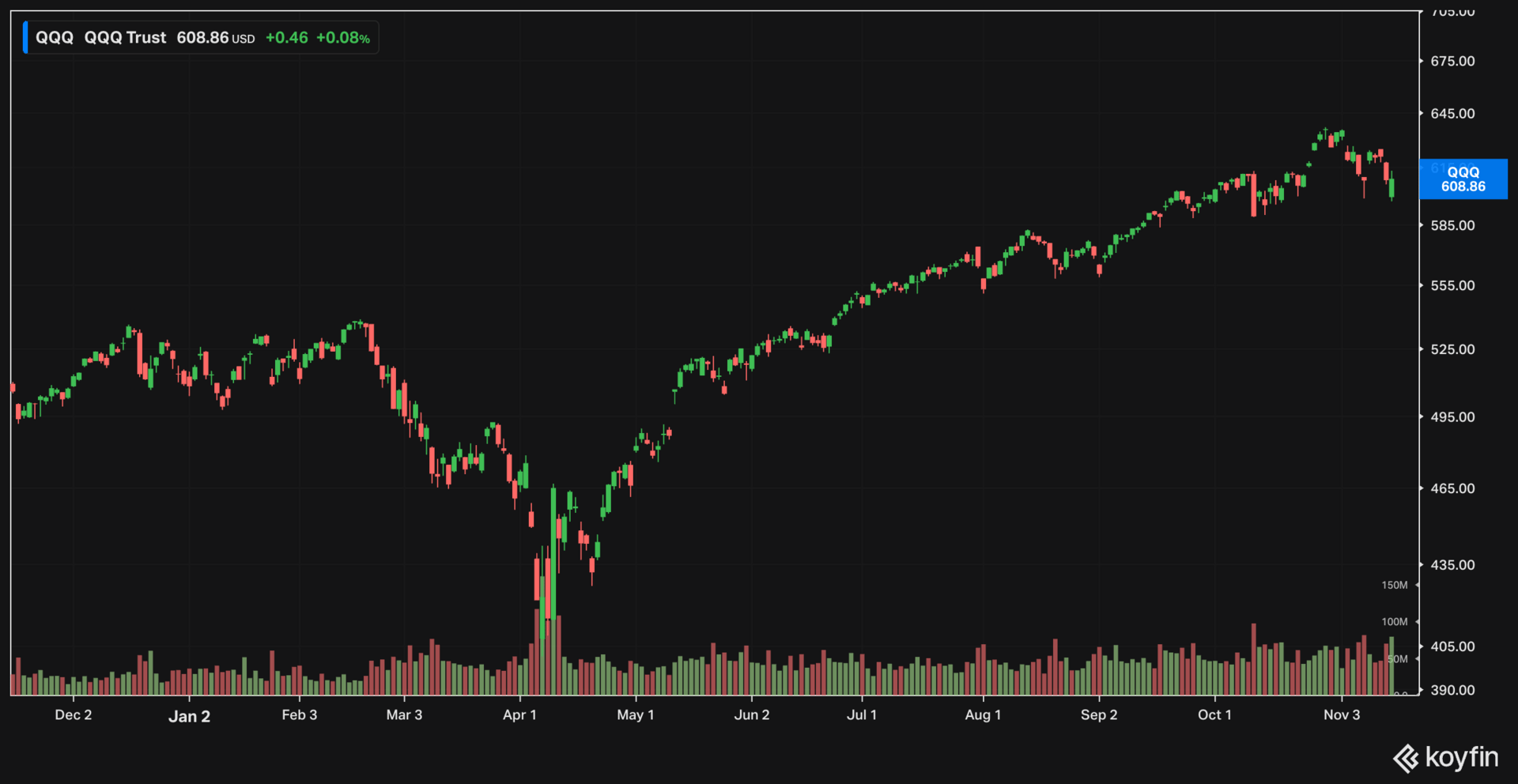

The distribution days in tech are increasing. They are happening more frequently. QQQ tested its 50-day moving average three times since September, and every time the bounces have been getting weaker. In the meantime, there has been a rotation into other areas of the market. The hot momentum money has found a new playground – biotech. Even energy is starting to show relative strength. The heavy-volume accumulation days in solar stocks are standing out. I don’t know if those groups are large enough to lead the overall market, but this is where capital has been flowing.

AI-related stocks have been under heavy pressure lately. This is not their first rodeo. Every time the AI-investment thesis has been questioned in the recent past, we saw headlines that have led to a bounce in the field. Last week, AMD’s CEO said she expects 35% annual sales growth for the next three to five years, driven by insatiable demand for AI chips. Nvidia reports earnings on November 19th. What do you think they will say about anticipated growth? Probably something similar. The question is how much of that is already priced in? The market reaction will tell us. If NVDA breaks down, the rest of the market will follow swiftly. The odds are that a pullback to 170-160 will be defended.

Reply