- Howie Town

- Posts

- Momentum Monday - Choppy With A Chance of Anything as Apple Hits All-Time Highs

Momentum Monday - Choppy With A Chance of Anything as Apple Hits All-Time Highs

As a reminder, MarketSurge (by Investor’s Business Daily) is now a sponsor of the weekly show. All the charts you have been seeing in the videos and will continue to see are from MarketSurge. They are offering my readers 2 months for $59.95 - save $239. That's 80% off the most powerful stock research platform for individual investors.

Good morning…

I am a day late posting this but it does not matter much because the market is rather choppy as it decides what to do next.

The good news for optimists like me is $AAPL ( ▼ 0.85% ) and $GOOG ( ▼ 0.84% ) my two largest positions hut all-time highs today. It is hard to be bearish when two global technology and consumer cash juggernauts hit all-time highs. Interest rates are creeping down as well.

As usual, Ivanhoff and I dive into the markets deeper to try and get a feel for what is next…have a listen/watch…

Welcome back to Momentum Monday!

In today’s episode of Momentum Monday, Ivanhoff and I discuss the following:

Momentum Stocks Pullback Recap

Market Leaders Show Resilience

Private Lending & System Risks

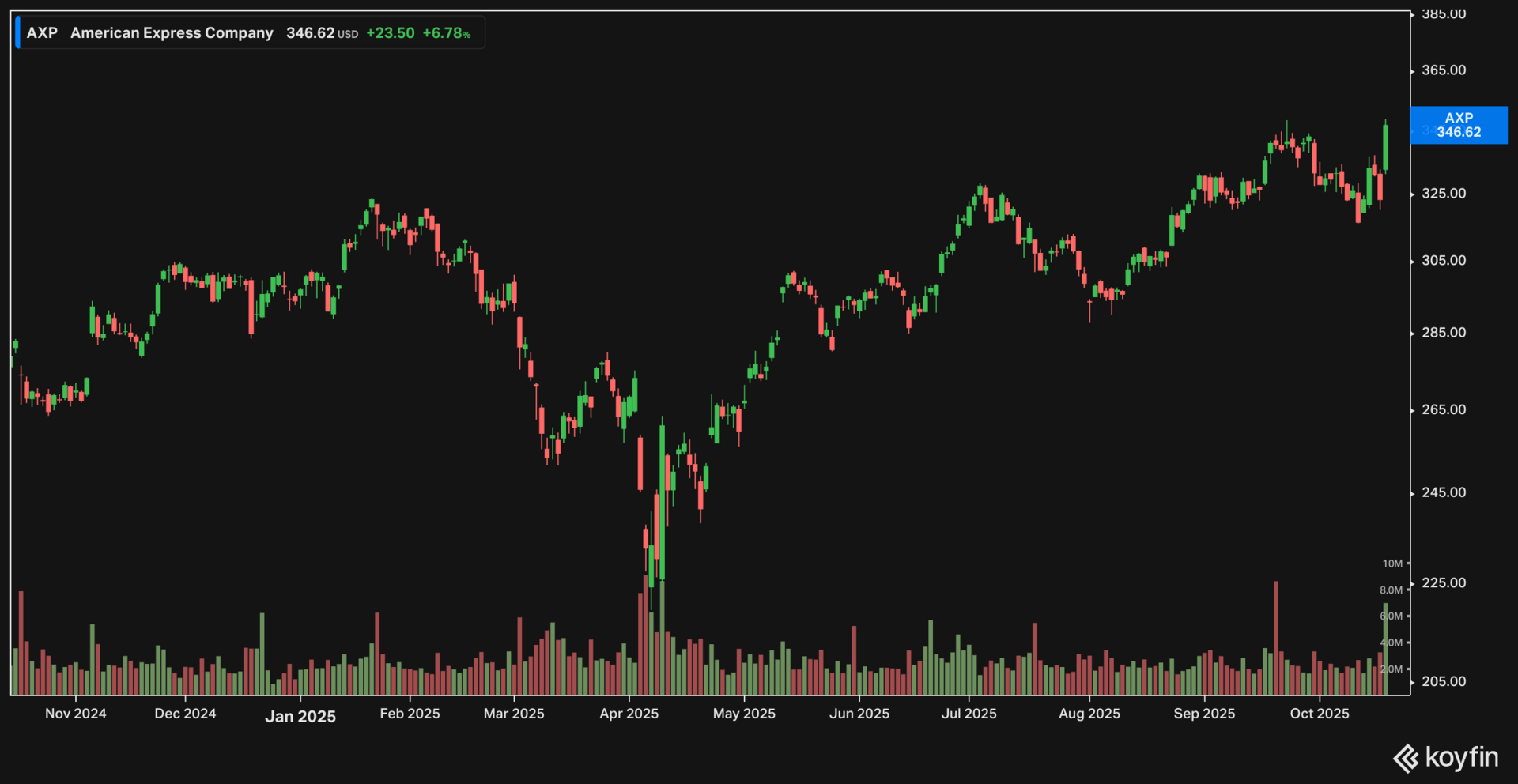

Spotlight: Banking, Home Builders, Earnings

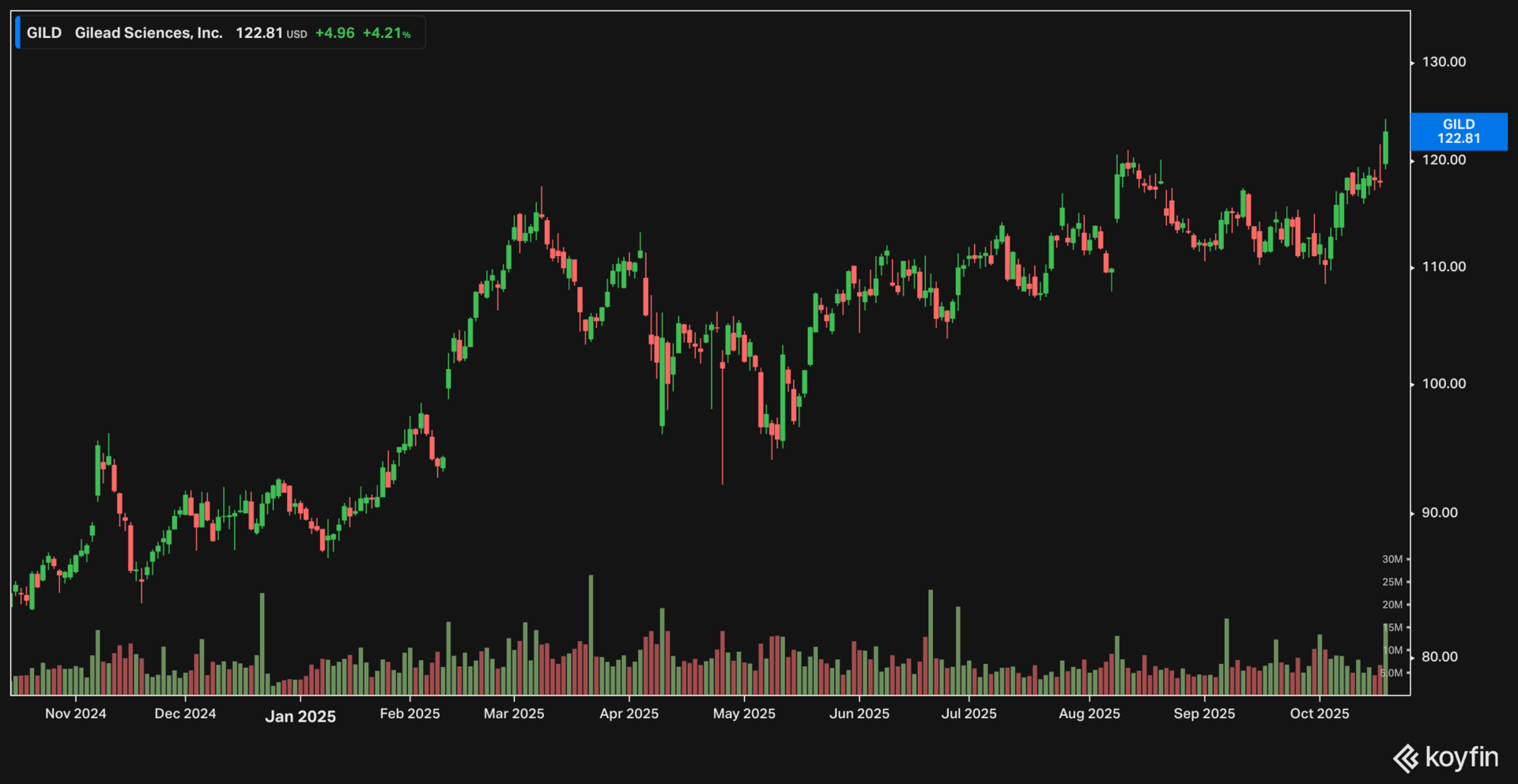

Rotations: Healthcare, Defensive Plays, Crypto

Tech Outlook & Global Uncertainties

In This Episode, We Cover:

Here are Ivanhoff’s thoughts:

The indexes barely sneezed last week, and the high-momentum flyers from quantum computing, nuclear, space, drones, rare earth metals, robots, crypto, and AI pulled back 10-40%. The price action in momentum stocks is often a precursor of what might happen in the general market. Timing it is the tricky part as sector rotations could continue to keep the indexes near their all-time highs.

The market is currently in a range-bound, choppy mode. In such an environment, breakouts don’t work for more than a day or two and often lead to a reversal. Breakdowns don’t last too long either, as the dips near support levels are getting bought. The market is digesting its recent gains and looking for new catalysts. They are right around the corner.

The new earnings season has just begun. Morgan Stanley crushed estimates and gapped up. Then, lending troubles in select regional banks brought down the entire financial sector, and Morgan Stanley gave back its gap. American Express also reported strong results, gapped up, and finished strongly.

It is a scalper’s tape for nimble traders for the time being, where trading less and focusing on earnings movers makes sense until the next clear swing move.

Reply