- Howie Town

- Posts

- Momentum Monday - Degeneracy Meets Vibes...What Could Go Wrong? And Hello From The Dolomites

Momentum Monday - Degeneracy Meets Vibes...What Could Go Wrong? And Hello From The Dolomites

Also - The AI Circle Jerk Spendalooza

As a reminder, MarketSurge (by Investor’s Business Daily) is now a sponsor of the weekly show. All the charts you have been seeing in the videos and will continue to see are from MarketSurge. They are offering my readers 2 months for $59.95 - save $239. That's 80% off the most powerful stock research platform for individual investors.

Good morning from The Dolomites where the government has been shut down since WW2 and the $VIX ( ▲ 18.13% ) is still 4.

I have enjoyed my full week off from the newsletter even though I have been brimming with ideas as I cycled in the Alps with friends. One thing I did get started is an outline of a book on the history of ‘The Degenerate Economy’ and what are some highly possible futures.

It is awful here in the Dolomites with literally nothing to do or see…

It’s 1:30 in the afternoon here and we have biked, hiked, stretched, steamed, cold plunged and spa’d before the markets open.

If I could beam myself to the Dolomites every Sunday evening for 24 hours from Coronado, it would be nirvana.

The good news is the ‘circle jerk’ of spend that is Oracle, Microsoft, Open AI, Nvidia and Silicon Valley might make my nirvana a reality by next year.

This ‘circle jerk’ of spend could maybe, possibly, sort of, be a sign of too much stupid behavior but oh my goodness the cash flow of these companies. Who am I to call a top.

In the meantime, weed is basing, psychodedlics ( $PSIL ) and biotechs with no revenue are breaking out and FaceMetaBook launched ‘Vibes’ which is universally hated but probably a massive hit in the making because nothing goes better with ‘degeneracy’ than weed and psychodelics.

If you are not caught up by this riff, tune in below to Ivanhoff solo our Momentum Monday. Ivanhoff is covering for me this week which I appreciate…

Welcome back to Momentum Monday!

In today’s episode of Momentum Monday, Ivanhoff and I discuss the following:

Intro & Market Recap

Momentum Stocks Under Pressure

Sector Rotations & Energy Surge

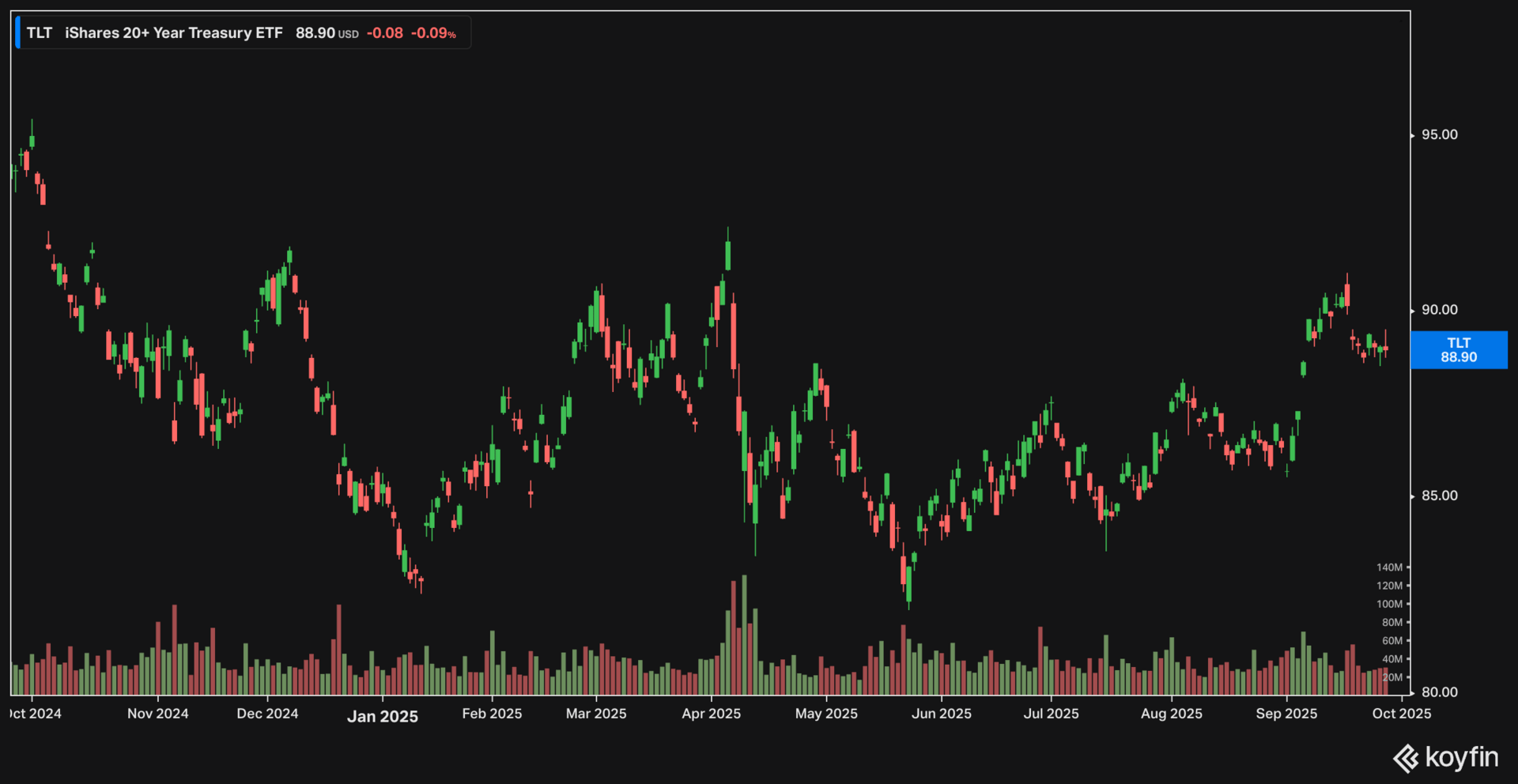

Interest Rate Plays: Treasuries & Small Caps

Special Sectors: Biotech & Government Moves

Stock Setups & Next Week’s Watchlist

In This Episode, We Cover:

Last weekend, we discussed the market becoming a bit frothy and setting up for a potential shakeout. This is exactly what we saw. Those pullbacks are normal during bull markets, and they create better entry opportunities near rising 20, 50, and 100-day moving averages.

When the market is in a pullback mode, a 1-2% drop in a popular index like the Nasdaq 100 could coincide with a 20% drop in a high-momentum stock. We saw that in recent high flyers in robotics, quantum, crypto, and nuclear last week. In fact, the behaviour of high-momentum stocks is a major sign of what to expect in the near term. If they just go sideways and continue to tighten up and set up, there’s probably a bounce around the corner. If they got pummeled, there’s likely more volatility ahead.

Typically, corrections in bull markets happen through sector rotation. Energy and metal stocks made a strong push last week. Can we see another group step up next week? Solar stocks seem to be setting up, but it is rare to see only one industry lead when the rest of the market is under pressure. The odds are we will see more choppiness.

Reply