- Howie Town

- Posts

- Momentum Monday - Everyone Loves Google and Eli Lilly Hits $1 Trillion

Momentum Monday - Everyone Loves Google and Eli Lilly Hits $1 Trillion

As a reminder, MarketSurge (by Investor’s Business Daily) is now a sponsor of the weekly show. All the charts you have been seeing in the videos and will continue to see are from MarketSurge. They are offering my readers 2 months for $59.95 - save $239. That's 80% off the most powerful stock research platform for individual investors.

Good morning…

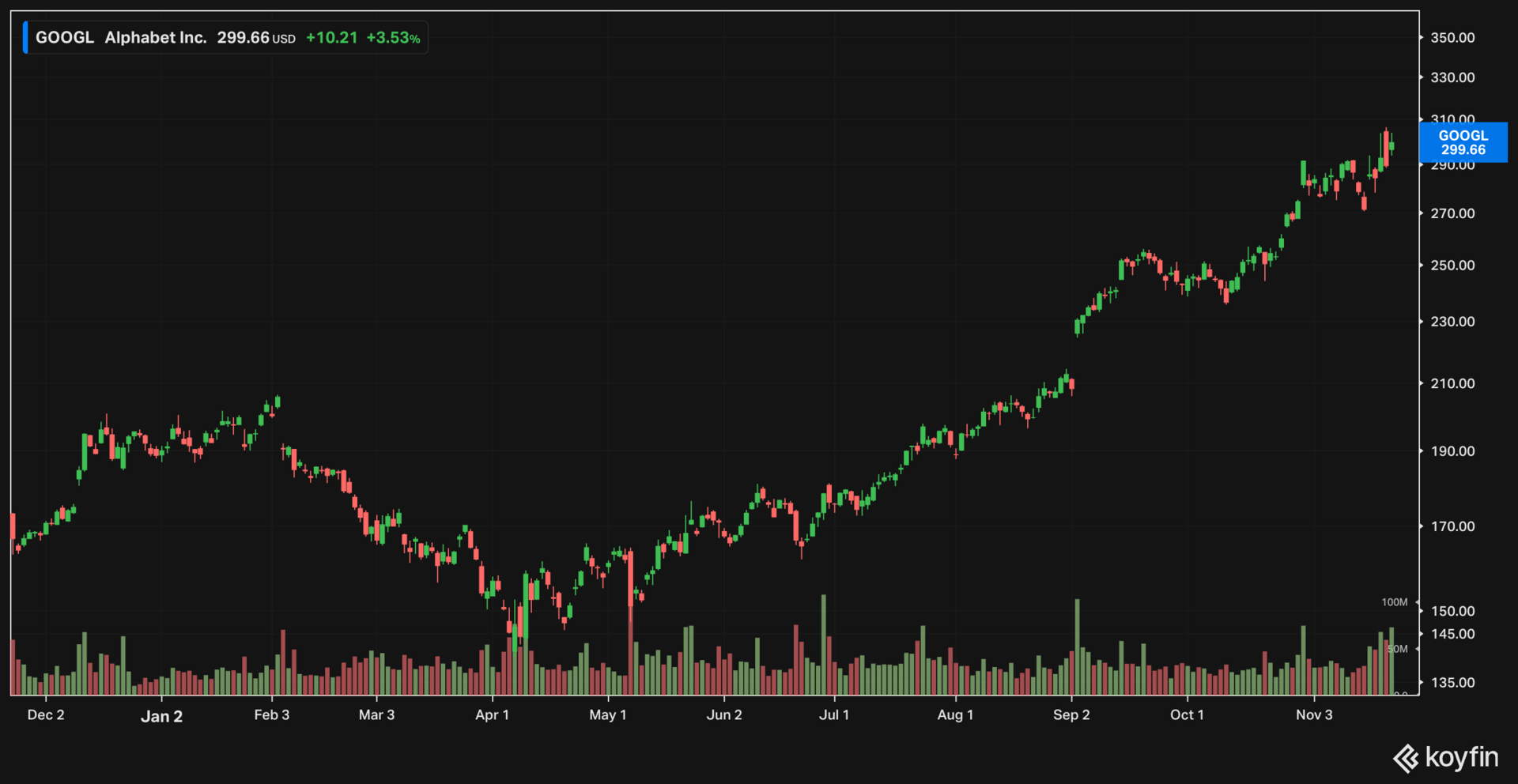

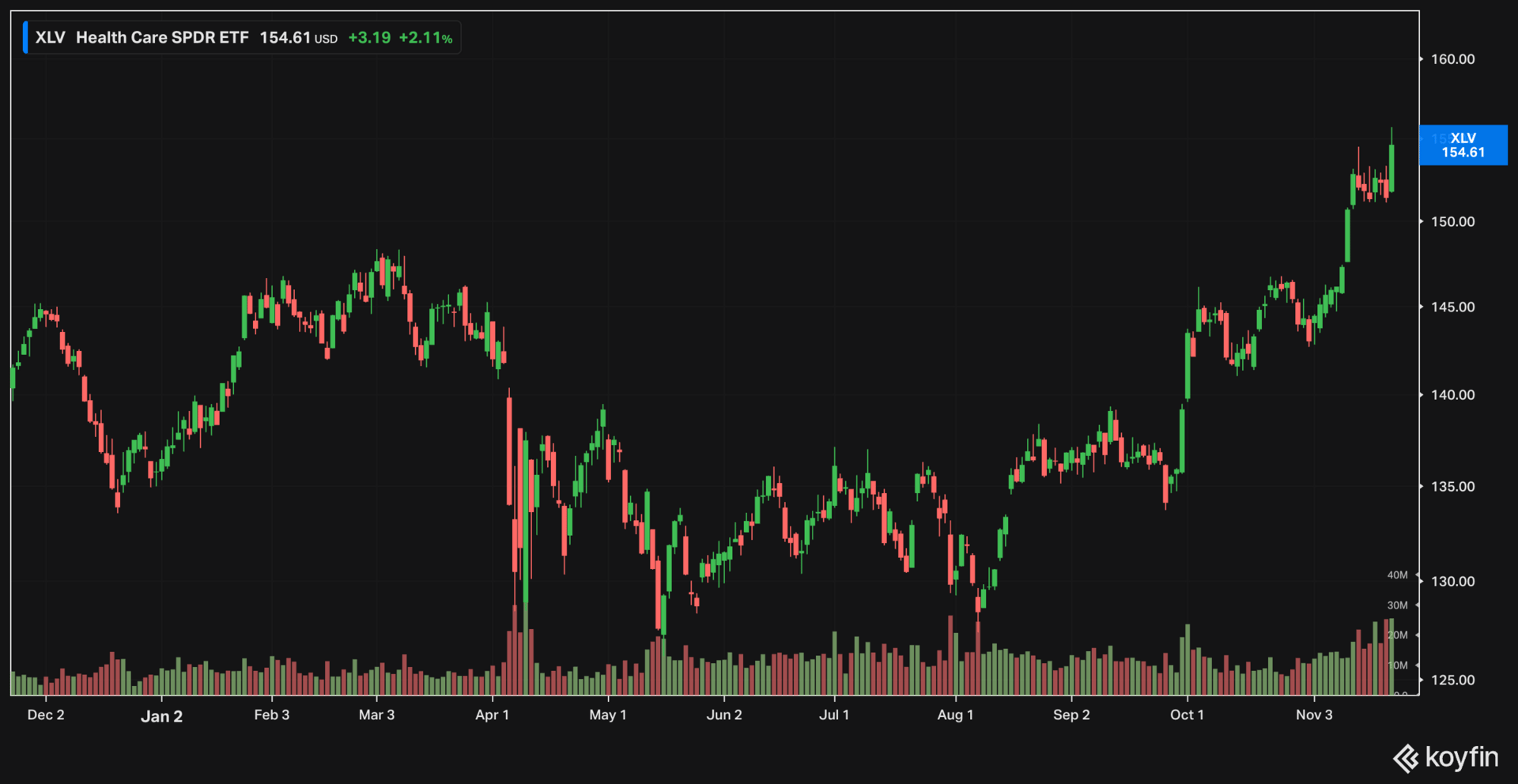

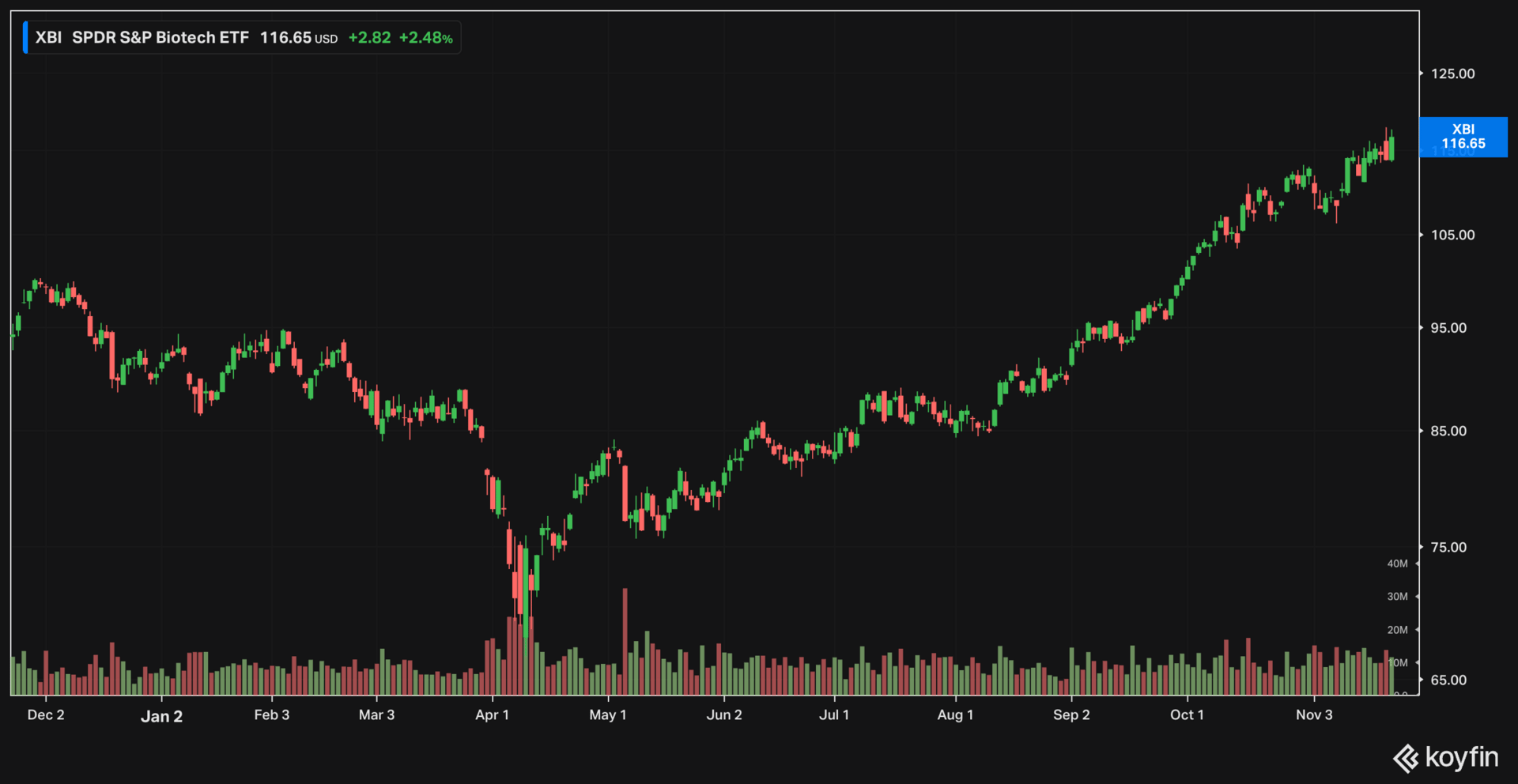

Ivanhoff and I got together like we do every Sunday and talked about the momentum in the markets - see the video below. Right now that is Google, healthcare and the biotechs. Healthcare ( $XLV ( ▼ 0.28% ) ) is being led by Eli Lilly and their trillion dollar valuation. Eli Lilly’s stock performance is a reminder why I index invest for the most part. There is no way I would have captured the 10x the stock has achieved the last 6 years on the heels of Ozempic had I not indexed.

Google went from dead to winner pretty quickly this year. u.

Right now $GOOG ( ▲ 3.74% ) is up another 6 percent today near $320 and now up over 50 percent on the year.

Marc Benioff the founder of Salesforce who carries quite a bit of weight tin technology tweeted this the other day after trying Google’s Gemini 3…

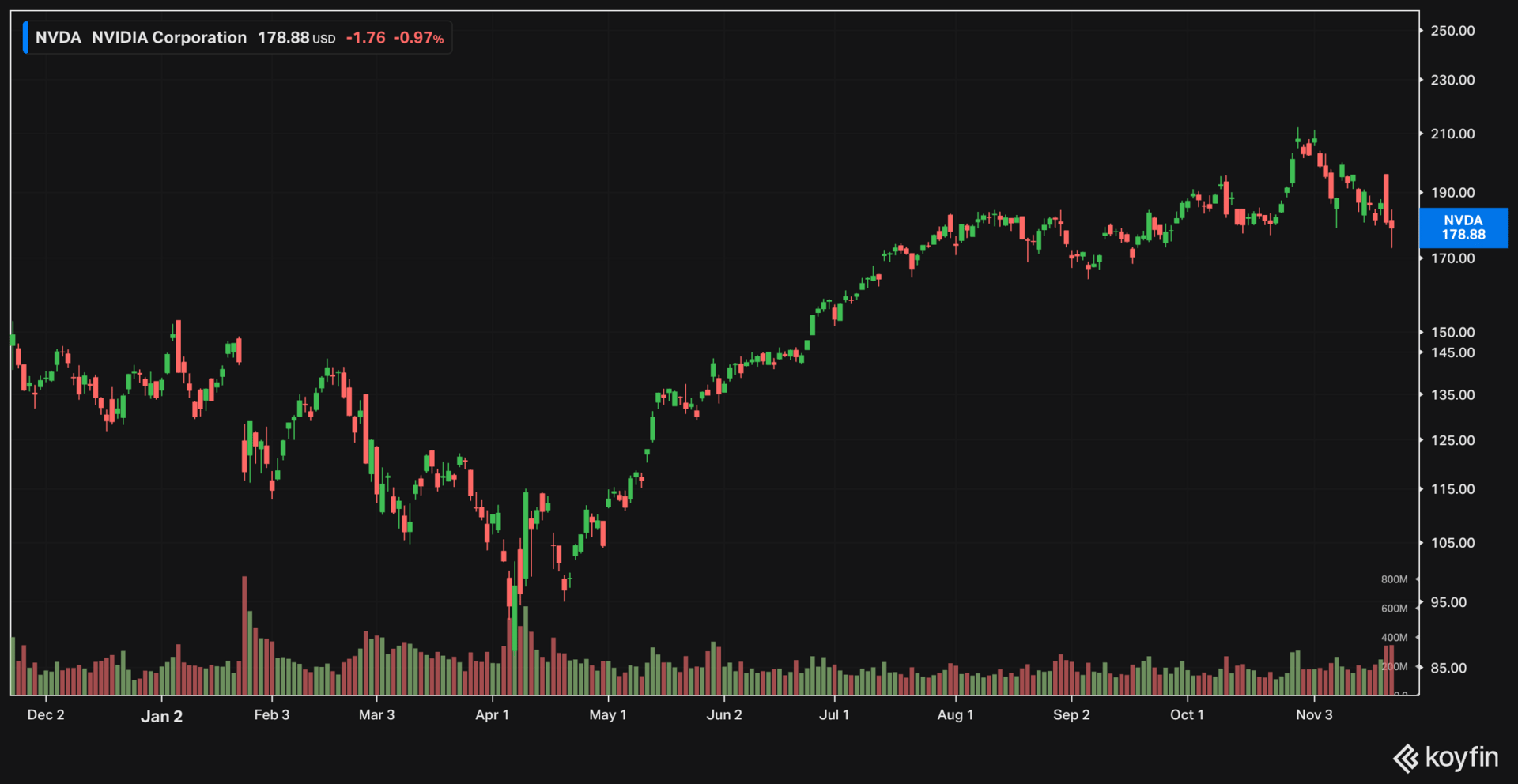

The market is now pricing in what would it look like if Google rwins the AI race because of their stack of compute, data and search. The big loser would be all the vendors of Open AI including Nvidia. This wont be the last time the whole AI group of giants gets rerated and the analysts spooked.

Hope you enjoy the video…

Welcome back to Momentum Monday!

In today’s episode of Momentum Monday, Ivanhoff and I discuss the following:

$NVDA ( ▲ 1.02% ) Earnings & Market Reaction

$GOOG ( ▲ 3.74% ) ’s Outperformance & AI Landscape

Tech Network Effects & Indexing Talk

Healthcare Rotation & Biotech Strength

AI Winners, Crypto, and Market Stress

Sector Pullbacks & Final Market Thoughts

In This Episode, We Cover:

$NVDA ( ▲ 1.02% ) Earnings & Market Reaction (0:00)

$GOOG ( ▲ 3.74% ) ’s Outperformance & AI Landscape (3:00)

Tech Network Effects & Indexing Talk (7:00)

Healthcare Rotation & Biotech Strength (10:00)

AI Winners, Crypto, and Market Stress (15:00)

Sector Pullbacks & Final Market Thoughts (19:00)

Here are Ivanhoff’s thoughts:

NVIDIA crushed earnings estimates and raised guidance once again, even while noting that it expects essentially zero sales to China over the next two quarters – a development that anyone familiar with the earnings-estimate game saw coming from a mile away.

What caught most people off guard wasn’t the headline beat, but the violent intraday reversal: a sharp gap higher followed by heavy selling that dragged the entire market lower. Meanwhile, Google (Alphabet) continues trading near all-time highs, up nearly 60% year-to-date. The market has clearly crowned its AI winner – for now.

This feels eerily similar to the DeepMind moment earlier this year, when one breakthrough player’s success was expected to cast a shadow over the rest of the AI ecosystem. The bigger question is whether Google’s aggressive plans to keep doubling its compute and building out massive AI infrastructure will actually require massive ongoing purchases of GPUs and related gear from NVDA, AMD, AVGO, TSM, ANET, MU, and others. In short: don’t be so quick to write off the rest of the AI supply chain. This pullback could very well turn into another attractive buying opportunity in the not-too-distant future.

Despite the recent damage, the broader bull market is not over yet. Both QQQ and SPY successfully tested and held above their rising 20-week moving averages – a level that has served as reliable support multiple times during strong bull runs in the past. This zone remains critical to watch. A decisive break below last week’s lows would put SPY at risk of a deeper 10% correction toward the 600–610 area.

In the meantime, the biotech sector is acting as if the rest of the market’s weakness doesn’t exist. I can’t fully explain the extraordinary relative strength in what is normally one of the riskiest and most volatile parts of the market. If you’re scanning for stocks acting constructively near their multi-month highs, an unusually large number of them are small- to mid-cap biotechs that most investors have never heard of: JAZZ, SNDX, BBNX, TEVA, ADPT, TXG, LQDA, and others.

Reply