- Howie Town

- Posts

- Momentum Monday - Google and Financials and Gold at All-Time Highs...Rotation Working It's Bullish Magic

Momentum Monday - Google and Financials and Gold at All-Time Highs...Rotation Working It's Bullish Magic

As a reminder, MarketSurge (by Investor’s Business Daily) is now a sponsor of the weekly show. All the charts you have been seeing in the videos and will continue to see are from MarketSurge. They are offering my readers 2 months for $59.95 - save $239. That's 80% off the most powerful stock research platform for individual investors.

Good morning…

I hope everyone had a great labor day. I was still in Muskoka where it was spectacular.

Ivanhoff and I got together as always to discuss the big trends and look for momentum.

Ivanhoff notes the continued rotation which he sees as healthy (I agree).

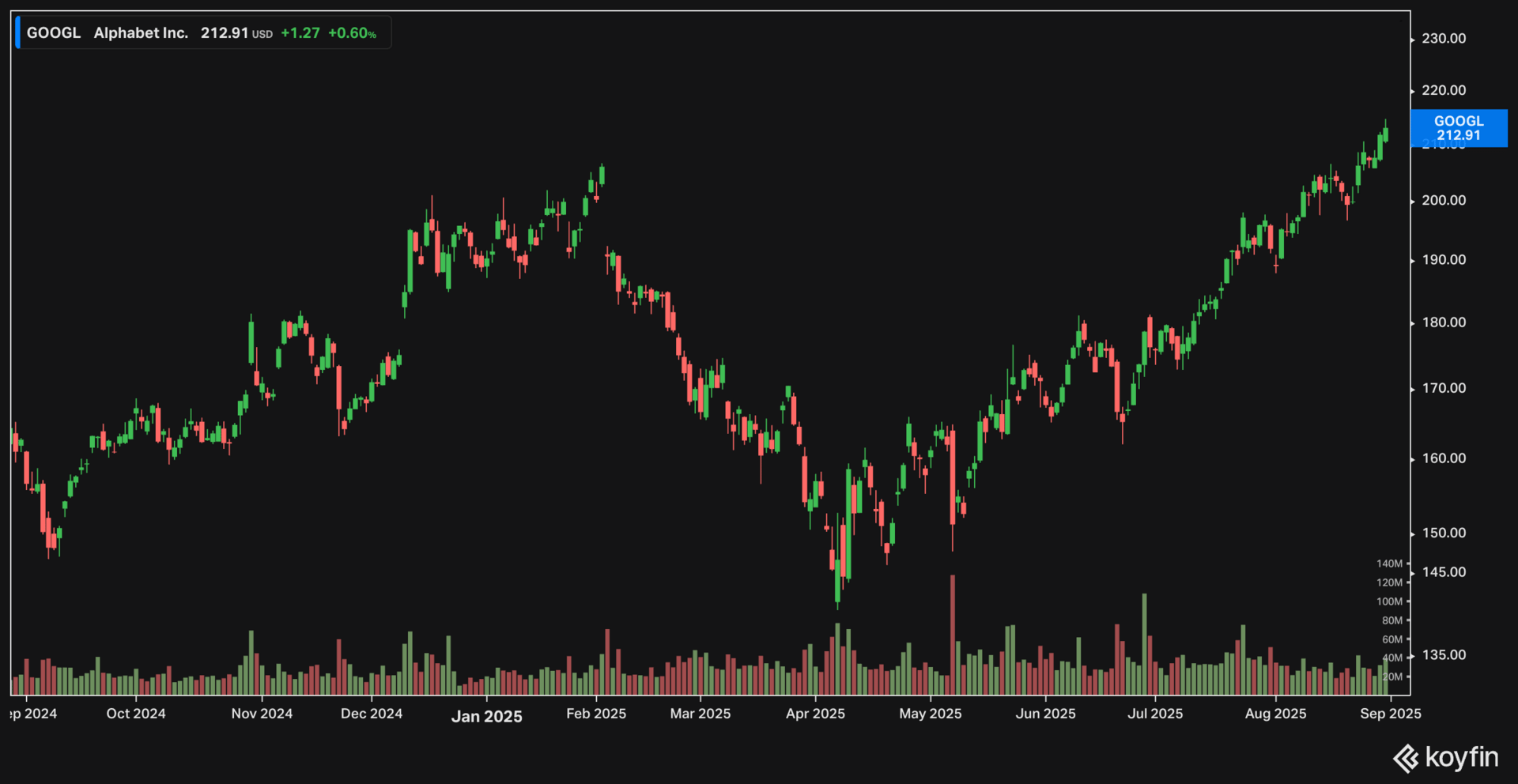

I see Google and American Express and other large financials at all-time highs and see few problems with that. Hard to see that as a negative.

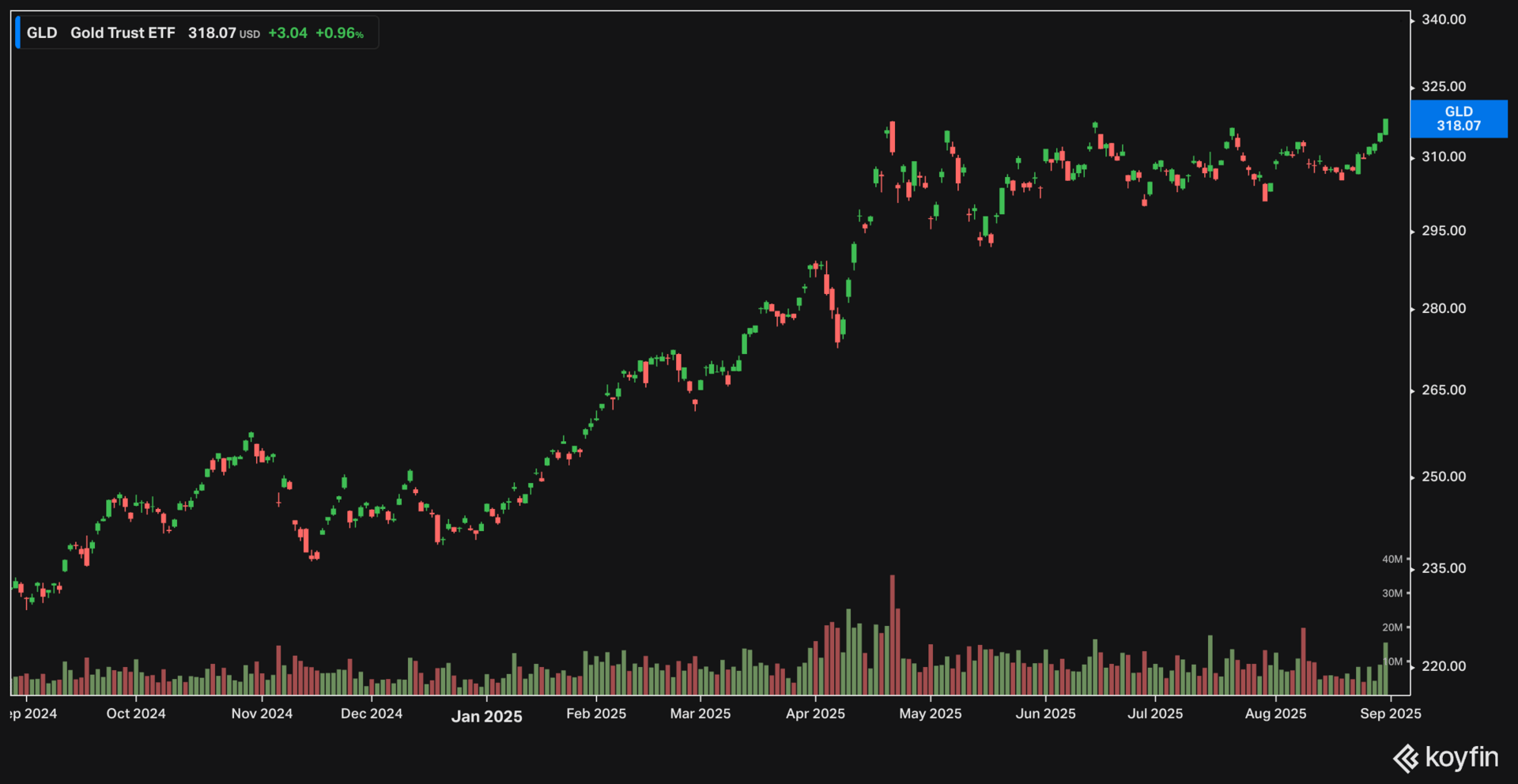

Gold is also working at all-time highs and Chinese internet stocks are getting a bid.

Let’s keep an eye and see if the distribution and rotation out of some ai plays and semiconductors leads to something bigger on the downside. YOu can watch the shpw below…or click and go through to Youtube….

Welcome back to Momentum Monday!

In today’s episode of Momentum Monday, Ivanhoff and I discuss the following:

September Market Sentiment

Sector Rotation and Market Correction

Small Caps and Emerging Markets

AI, Software, and Earnings Surprises

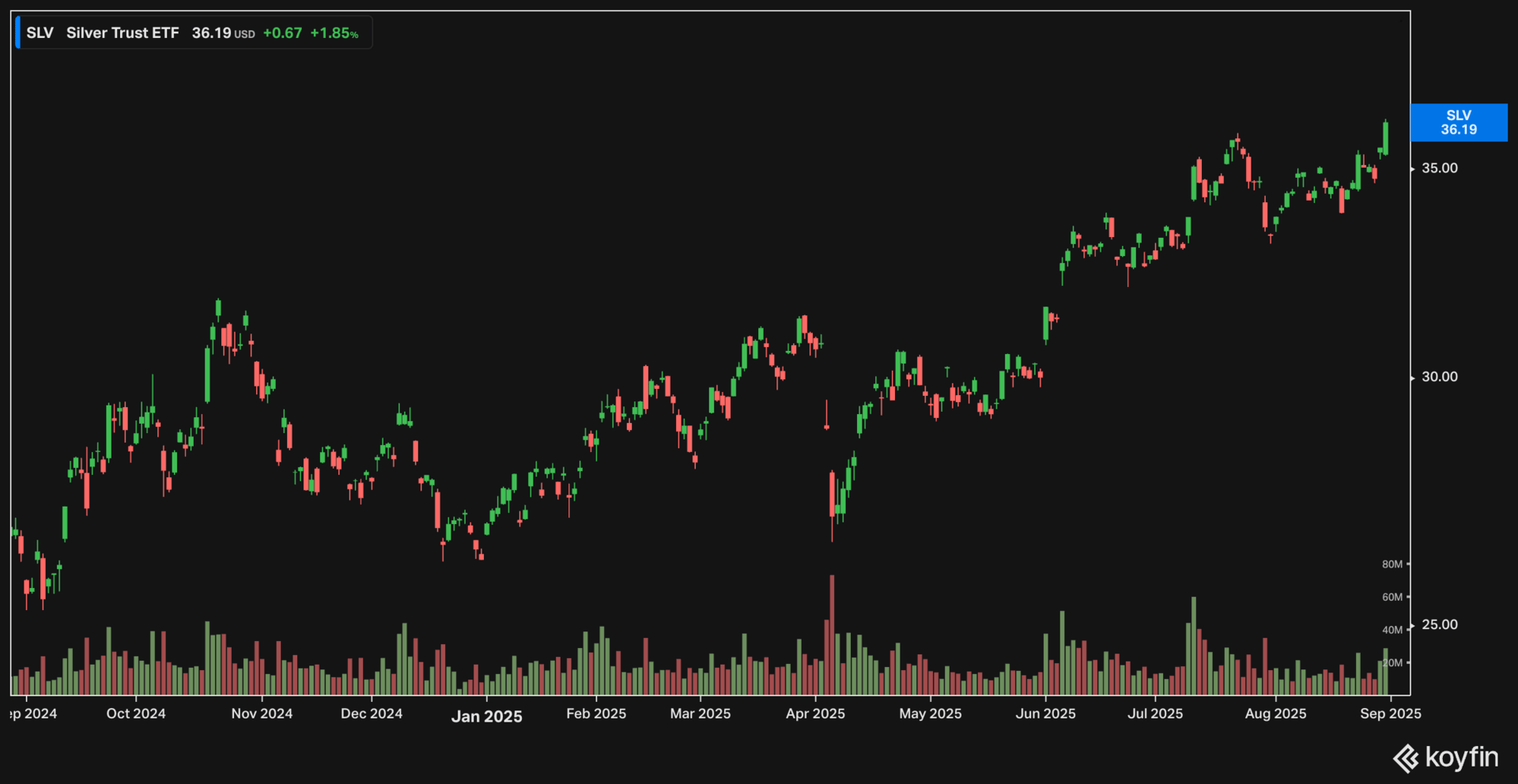

Big Tech, Gold, and Inflation Trends

Global Economy and Rotation Strategy

In This Episode, We Cover:

Here are Ivanhoff’s thoughts:

One of the most prominent characteristics of bull markets is that they correct through sector rotations. We are seeing it again. Anything related to AI has been under pressure lately. NVDA and MRVL sold off after their latest earnings reports. AI data center component stocks like VRT and energy stocks like CEG, VST, and GEV are in a pullback mode. Despite that, QQQ and SPY are trading within 1-2% of their all-time highs.

As AI is consolidating recent gains, there have been rotations into other groups:

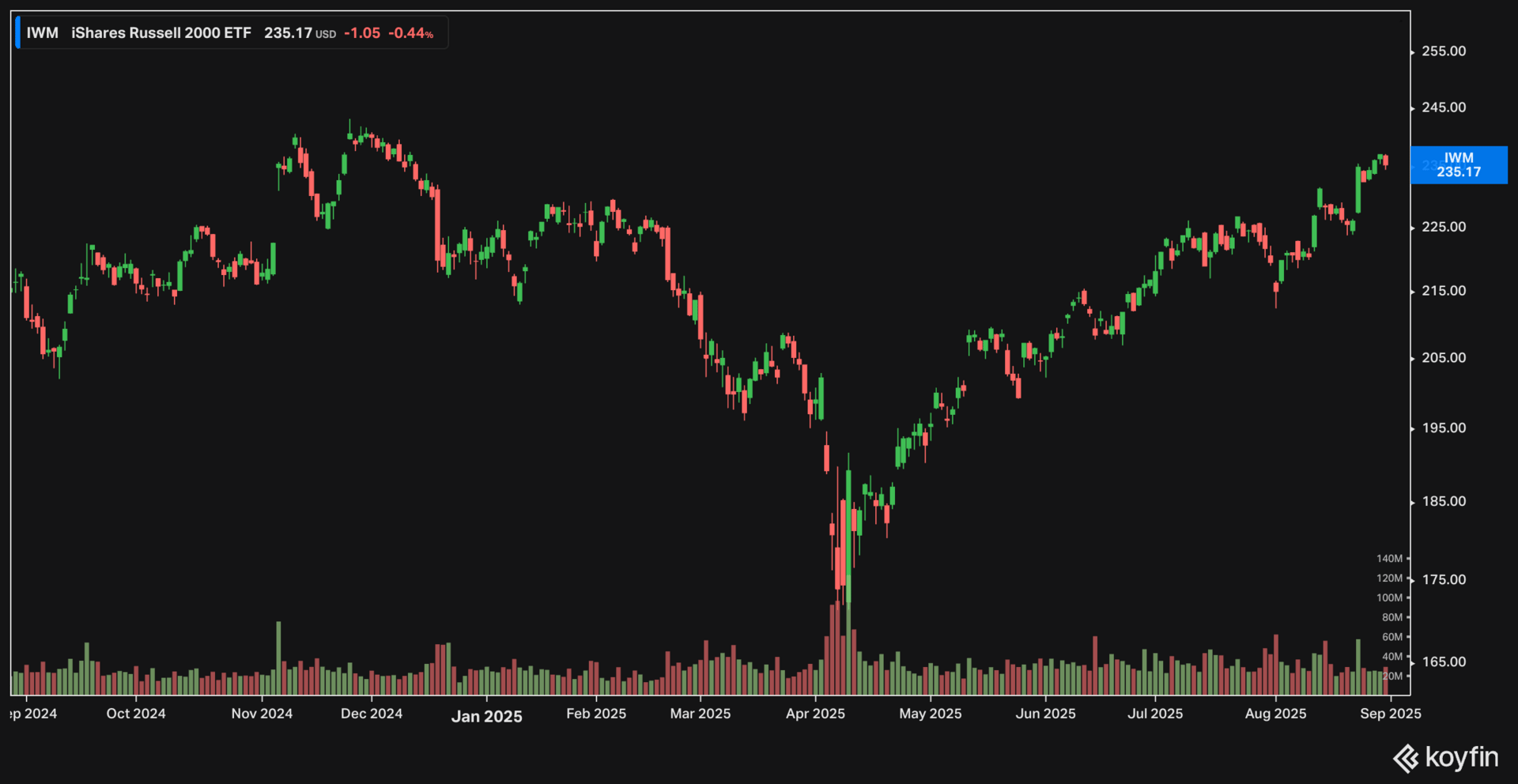

Small caps (IWM) had a big-volume breakout after the Fed’s chairman hinted that there might be a time for a rate policy change.

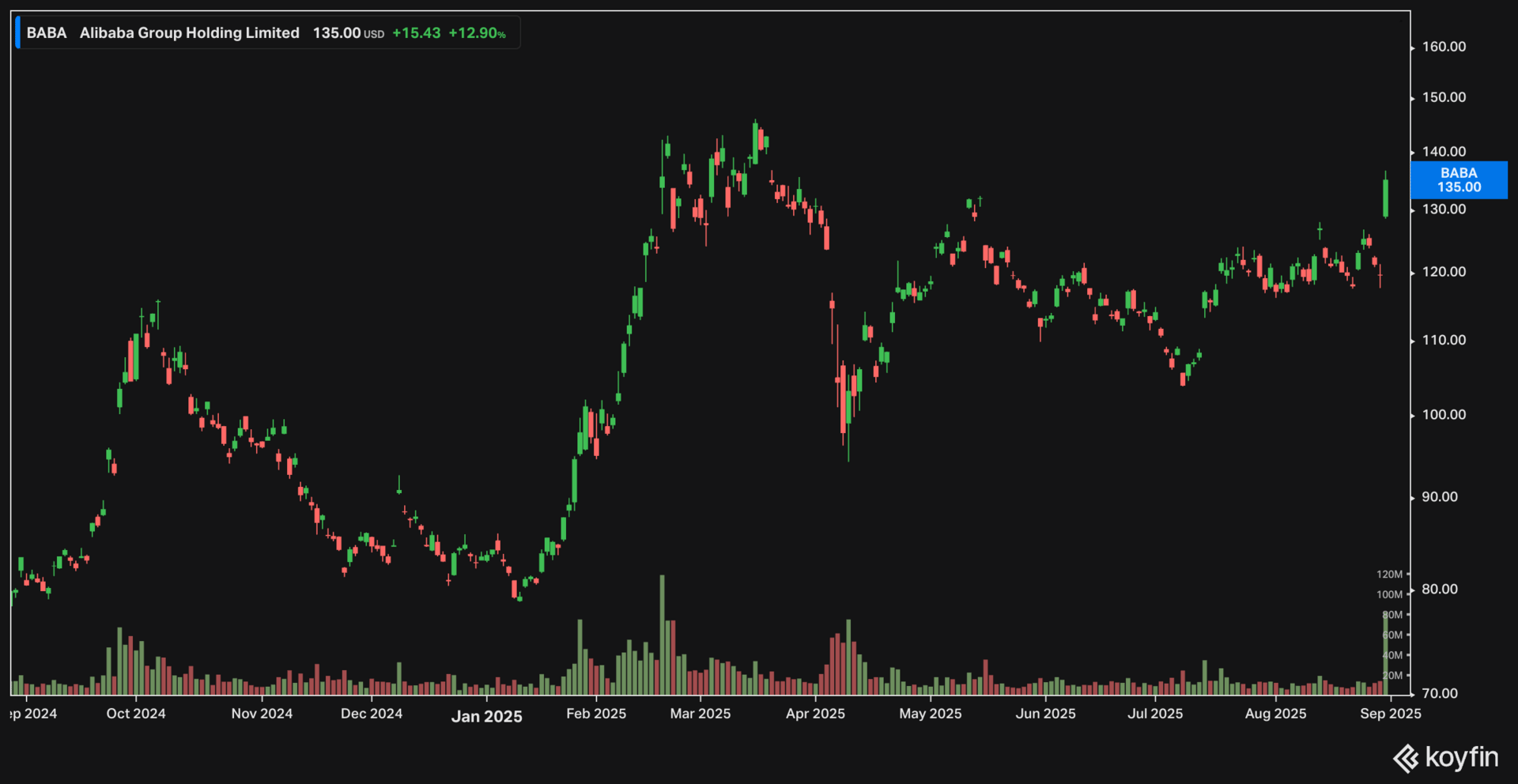

Chinese ADRs are starting to shine. BABA’s earnings were not impressive, but the stock went up 13% on huge volume last Friday when most tech stocks sold off. BABA is the leader, and many other Chinese stocks are acting constructively.

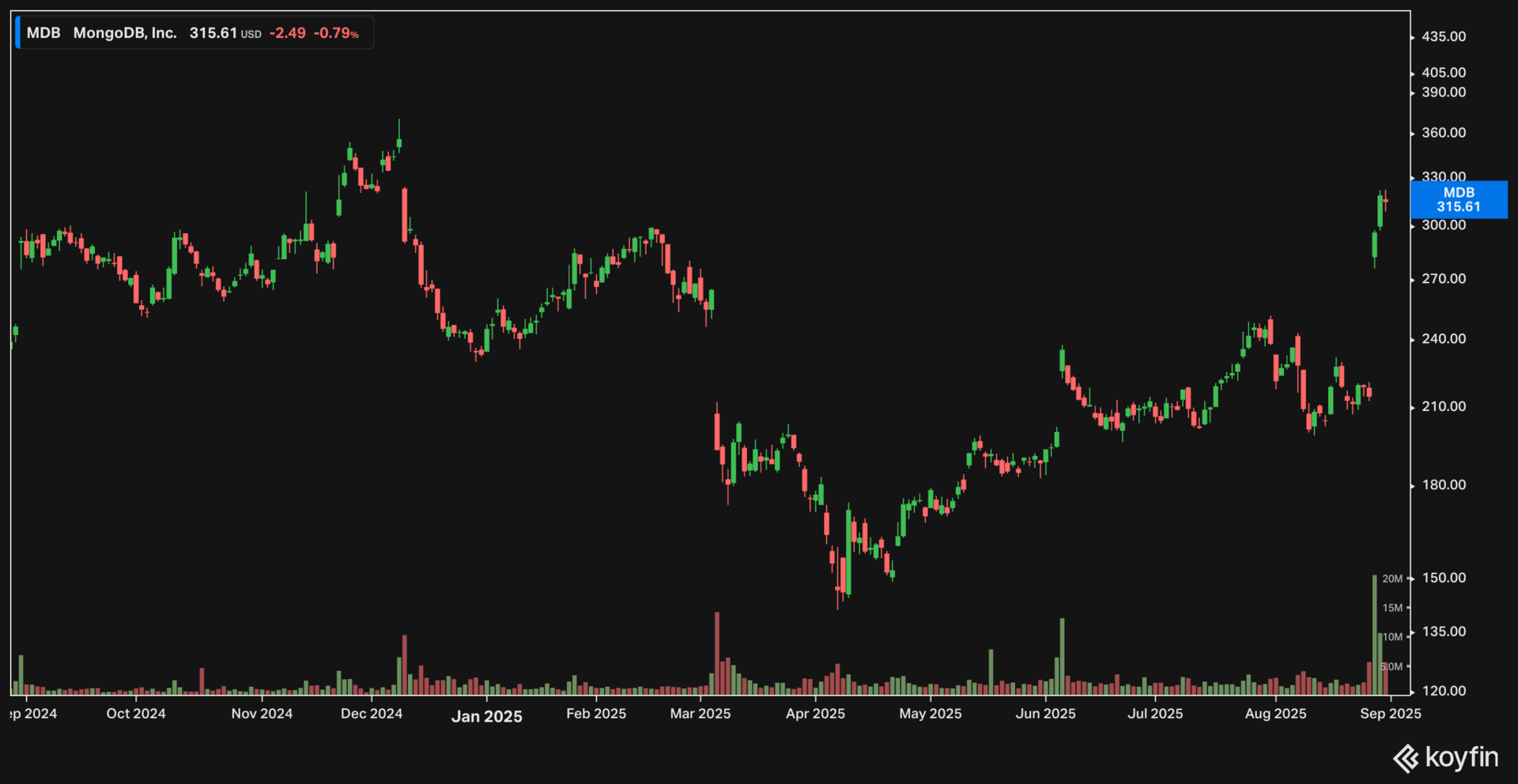

Software stocks have underperformed for a large window of time this year. The premise is that AI is going to disrupt first software, anything except cybersecurity. This makes sense to me, but the software industry has many different companies with different opportunities ahead of them. MDB and SNOW had big earnings surprises last week and had significant gains on heavy volume.

Not everything is calm in the market at the moment. We saw four distribution days in the indexes in the past couple of weeks heading into the historically weakest month for the market – September. Given the macro background is hard to expect a bigger correction right now, but a quick 4-5% shakeout is not out of question.

Reply