- Howie Town

- Posts

- Momentum Monday - Not Great, Not Horrible

Momentum Monday - Not Great, Not Horrible

As a reminder, MarketSurge (by Investor’s Business Daily) is now a sponsor of the weekly show. All the charts you have been seeing in the videos and will continue to see are from MarketSurge. They are offering my readers 2 months for $59.95 - save $239. That's 80% off the most powerful stock research platform for individual investors.

Good morning…

The market continues to offer up winners despite the heavy rotation.

I am reminded why I index for the most part by the price action in Eli Lilly which has shot to $1 trillion and all-time highs. There is no way I would have owned or held Eli Lilly the last 10 years during it’s historic run capped by its ‘fat pills’, and being indexed allowed me to participate. The indexes do for you what you may not be able to do yourself. It was 24 years ago that Enron was replaced by Nvidia in the S&P.

Of course, I like owning single stocks as well and this year I have done well because of $GOOG ( ▲ 1.39% ) . This new chart in the link below separates the two AI themes as Google’s Gemini powered by Google’s chips gets priced into the market.

new fave ai chart

get a feel for the sentiment in ai sector by watching these two baskets

$GOOG$NVDA$AVGO$TTMI$MSFT— Howard Lindzon (@howardlindzon)

12:45 AM • Nov 26, 2025

Healthcare and biotech continue to lead as well.

I am on the road so Ivanhoff did this weeks show on his own…hope you enjoy:

Welcome back to Momentum Monday!

In today’s episode of Momentum Monday, Ivanhoff discusses the following:

Market Recap & Recent Rally

New AI Leaders Emerge

AI Sector Rotations & Key Stocks

Biotech Strength & Breakouts

Gold, Miners & Crypto Comparisons

Final Thoughts & Strategy

In This Episode, We Cover:

Here are Ivanhoff’s thoughts:

Last weekend, we observed that the main indexes managed to close above their 20-week moving averages. They followed through and had five consecutive green days. The good mood is back. People are getting excited about a “Santa Claus rally” in December.

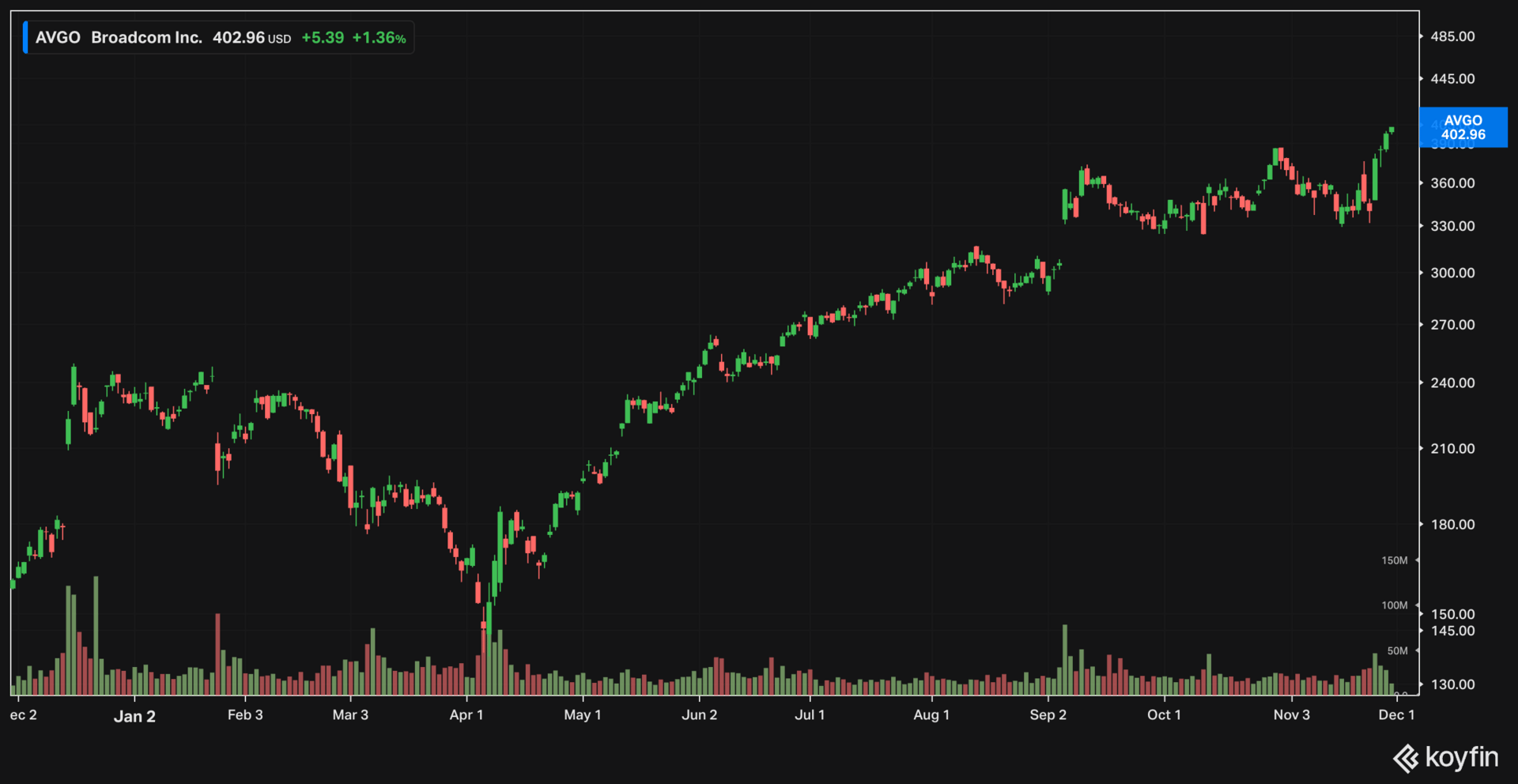

NVDA and PLTR were the undisputed leaders in 2023, 2024, and the first half of 2025. This hasn’t been the case lately. Unlike the Nasdaq 100, both remain firmly below their 50-day moving averages and show notable relative weakness lately. There are new leaders in town – GOOGL and AVGO. The AI data centers component stocks have also recovered relatively quickly and are looking to continue to outperform – some examples include MU, COHR, CRDO, CLS, and VRT.

In the meantime, biotech continues to fly, lifting the small-cap index with it. Small caps outperforming is one of the main risk-on signs. Besides, if a negative reaction to NVDA’s earnings and accusations of creative accounting cannot bring the market down, I don’t know what can, at least for the time being.

Reply