- Howie Town

- Posts

- Momentum Monday - Small Caps Continue To Break Out In The Something For Everyone Market...More So For The Worriers

Momentum Monday - Small Caps Continue To Break Out In The Something For Everyone Market...More So For The Worriers

As a reminder, MarketSurge (by Investor’s Business Daily) is a sponsor of the weekly show. All the charts you have been seeing in the videos and will continue to see are from MarketSurge. They are offering my readers 2 months for $59.95 - save $239. That's 80% off the most powerful stock research platform for individual investors.

Good morning…

This market continues to have something for every type of investor. This week we have bank earnings setting off earnings season, our FED leader Powell being sued by Trump, Iran trying to free themselves, and Trump telling credit card companies they have limits to what they can charge.

If you like to worry, this market has something for you and if you like breakouts this market has something for you.

Ivanhoff and I tour the markets as usual, covering rates, homebuilders, big tech, energy and banks…and I share some fresh ideas and thoughts on my positions.

I prefer to panic first so with the $VIX at 14 and the semiconductor index stretched 30 percent above the 200 day moving average, I like the idea of booking some profits with the goal is reinvesting the next time the $VIX hits 30.

Please share and subscribe to our weekly YouTube show below

Welcome back to Momentum Monday!

In today’s episode of Momentum Monday, Ivanhoff and I discuss the following:

Market Uncertainty & The VIX

The Run in Semiconductors ($NVDA ( ▼ 5.46% ) & $MU ( ▼ 3.13% ) )

Global Tensions & Domestic Policy

The Bond Market & Homebuilder Rally

AI Energy Needs & Bloom Energy ($BE ( ▼ 3.55% ) )

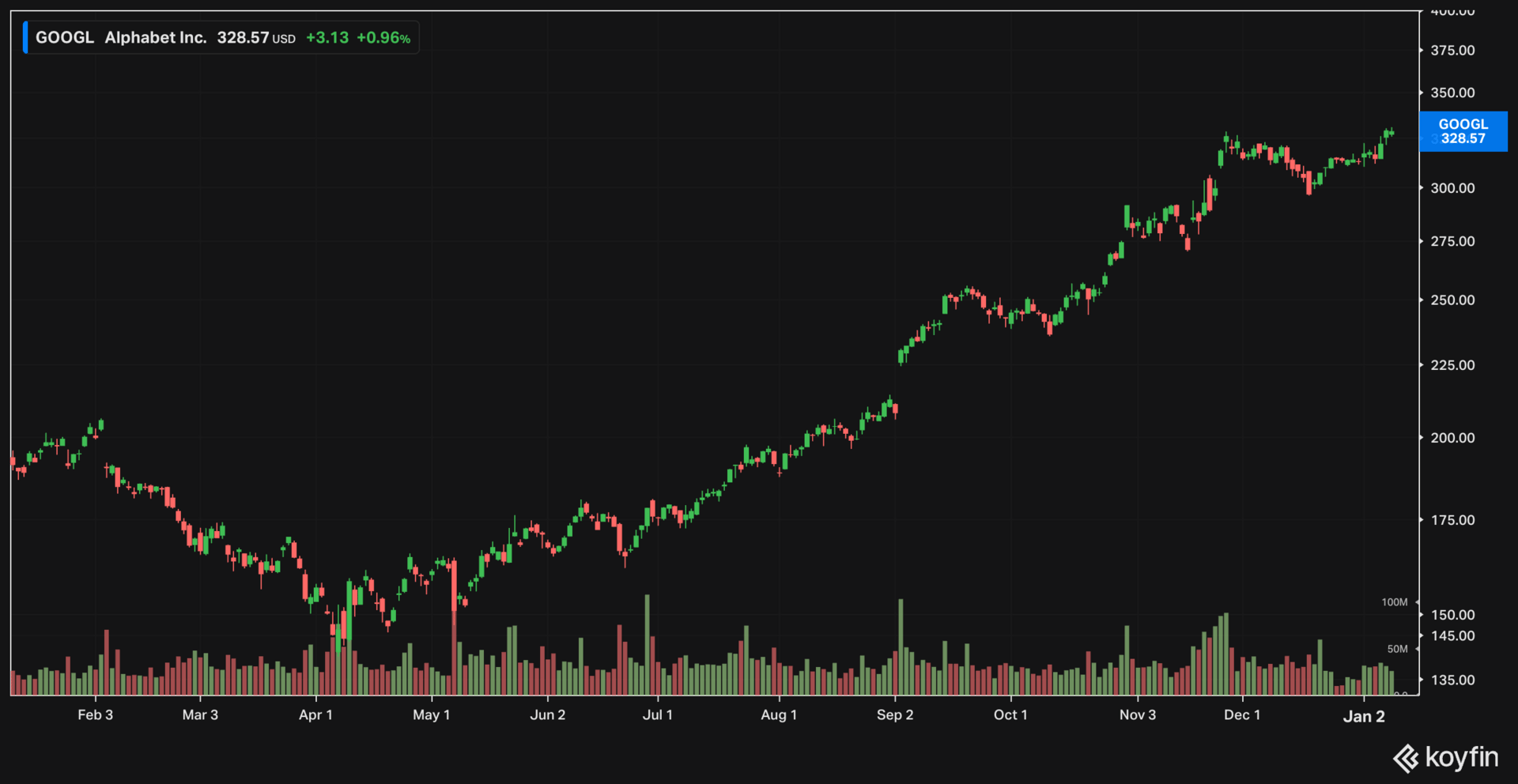

Streaming Wars: $NFLX ( ▲ 2.29% ) vs. YouTube/$GOOGL ( ▼ 1.76% )

Swing Trading Setups: $SHOP ( ▲ 4.68% ) , $NVDA ( ▼ 5.46% ) & Calls

International Plays & Profit-Taking Strategy

In This Episode, We Cover:

Market Uncertainty & The VIX (0:00)

The Run in Semiconductors ($NVDA ( ▼ 5.46% ) & $MU ( ▼ 3.13% ) ) (1:40)

Global Tensions & Domestic Policy (3:05)

The Bond Market & Homebuilder Rally (6:51)

AI Energy Needs & Bloom Energy ($BE ( ▼ 3.55% ) ) (11:55)

Streaming Wars: $NFLX ( ▲ 2.29% ) vs. YouTube/$GOOGL ( ▼ 1.76% ) (15:47)

Swing Trading Setups: $SHOP ( ▲ 4.68% ) , $NVDA ( ▼ 5.46% ) & Calls (19:58)

International Plays & Profit-Taking Strategy (22:41)

Here are Ivanhoff’s thoughts:

It is no news that small caps tend to outperform in early January. It has happened again this year. Russell 2k (IWM) tested its 50-day moving average on January 2nd, and then it went straight up, making a new all-time high. Also, not surprising – the big lift came from sectors that lagged last year – energy, financials, and beaten down groups like nuclear, robotics, crypto, space, rare earth metals, etc. This basically happens in the first few weeks of almost every year.

The large-cap indexes, QQQ and SPY, are lagging behind small caps but are also near or at new all-time highs.

AMZN is pushing higher in anticipation of the Supreme Court decision on tariffs. SHOP might also benefit alongside other retailers. After a brief consolidation, GOOGL broke out to new all-time highs. TSLA tested its 20-week moving average, where it found support. NVDA pulled back to its 20-day moving average, where buyers stepped in. Both are lagging the market indexes but are likely to set up at some point if the market remains strong.

Memory chip stocks started the new year just like they finished the previous one – leading the market. SNDK is up 800% since last August. MU is only up 200% for the same period.

Reply