- Howie Town

- Posts

- Momentum Monday - The Bull Market Is Still Here If You Remove Software and Crypto From Your Watchlists

Momentum Monday - The Bull Market Is Still Here If You Remove Software and Crypto From Your Watchlists

As a reminder, MarketSurge (by Investor’s Business Daily) is a sponsor of the weekly show. All the charts you have been seeing in the videos and will continue to see are from MarketSurge. They are offering my readers 2 months for $59.95 - save $239. That's 80% off the most powerful stock research platform for individual investors.

Good morning,

Before I get started…our fund 3 portfolio company Manscaped had a super bowl ad. It was hysterical and memorable.

As for the markets…there is a BIG bull market still under way. The easiest way to see it is to remove all software and crypto stocks from your watchlist.

The transportation stocks - Fedex and railoard $CSX ( ▲ 1.86% ) , infrastructure and telecom $CSCO ( ▲ 2.99% ) , banks, energy, select semiconductors (at this point they are just infrastructure) metals, industrials and staples are all moving higher. Ivanhoff and I share the charts and ideas in today’s show below…

Welcome back to Momentum Monday!

In today’s episode of Momentum Monday, Ivanhoff and I discuss the following:

Market Divergences and Semi Strength

AI’s Equalizing Effect on Coding

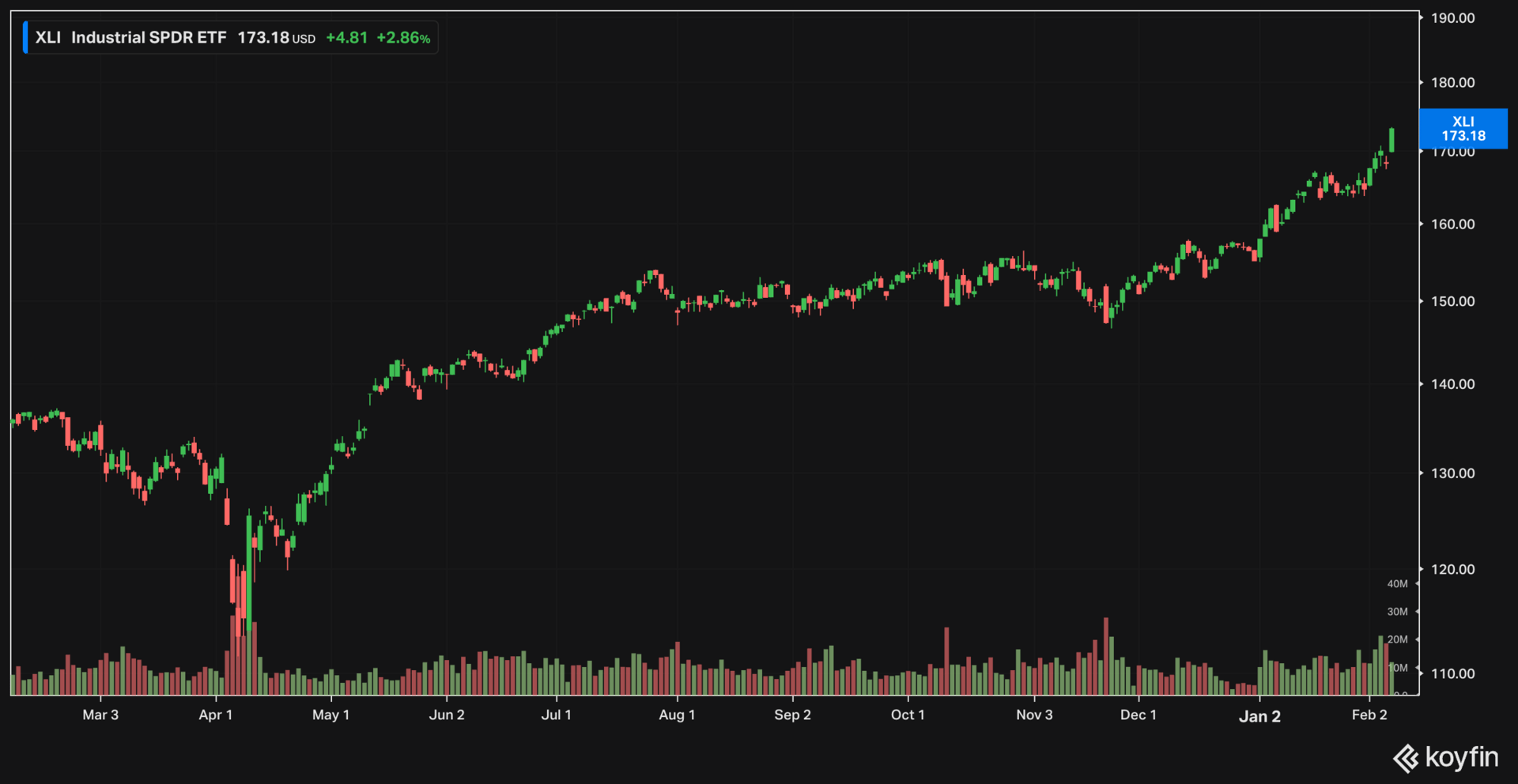

Shifting from Software to Industrials

Biotech Momentum and Amgen

Deglobalization Asset Strategies

Infrastructure: Fiber Optics and Railroads

In This Episode, We Cover:

Here are Ivanhoff’s thoughts:

The latest reactions to tech earnings haven’t been bullish at all. Google crushed earnings estimates and gapped down. Palantir crushed estimates, gapped up initially, and then sold off quickly. Amazon missed earnings estimates and gapped down. AMD beat the estimates and sold off. META beat earnings estimates, gapped up, and quickly sold off. Upside gaps were used for profit-taking. Slight missteps were punished harshly. The only thing all big tech companies had in common this earnings season was announcing a significant increase in capex spending. This explains the relative strength in semiconductors and industrial stocks – anything needed to build AI data centers.

While tech and crypto have been under significant pressure lately, energy, regional banks, industrials, transportation, and consumer staples are making new highs. This is why I can’t really call the recent carnage in the market a correction. It is more of a sector rotation.

Then why are the headlines scary, and so many people are running away from the market and raising cash positions? Tech outperformed by such a large margin in the past 20 years that it has become “the market” in terms of market cap and capturing people’s attention. Everyone’s portfolio is tech-heavy, so a correction in tech is felt much harder by most.

Reply