- Howie Town

- Posts

- Momentum Monday - The Dips Are Getting Bought

Momentum Monday - The Dips Are Getting Bought

As a reminder, MarketSurge (by Investor’s Business Daily) is a sponsor of the weekly show. All the charts you have been seeing in the videos and will continue to see are from MarketSurge. They are offering my readers 2 months for $59.95 - save $239. That's 80% off the most powerful stock research platform for individual investors.

Good evening…

Sorry for late post but I have been bussssssy.

As the title says the dips are being bought. Could be the time of year, could be just plain old degeneracy and could be somebody hacked Berkshire Hathaway and is spending his cash on crazy momentum stocks…

As always, Ivanhoff and I tour the markets and share our thoughts and some fresh ideas. Scroll down to see the details of the video and the charts and watch part or all of the show.

Welcome back to Momentum Monday!

In today’s episode of Momentum Monday, Ivanhoff and I discuss the following:

Welcome & Market Sentiment

Market Strength and Policy Surprises

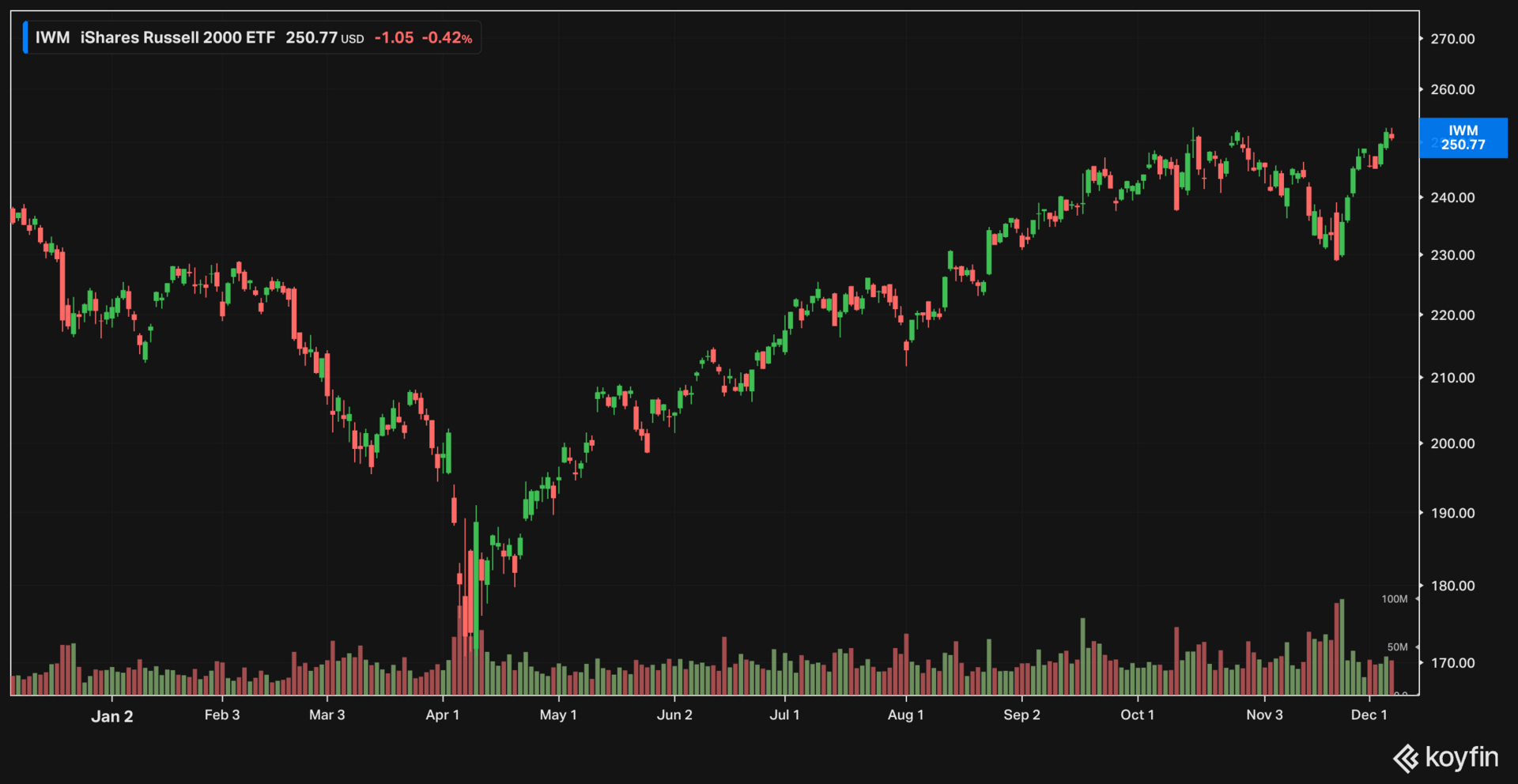

Small Caps and Next Gen Stocks

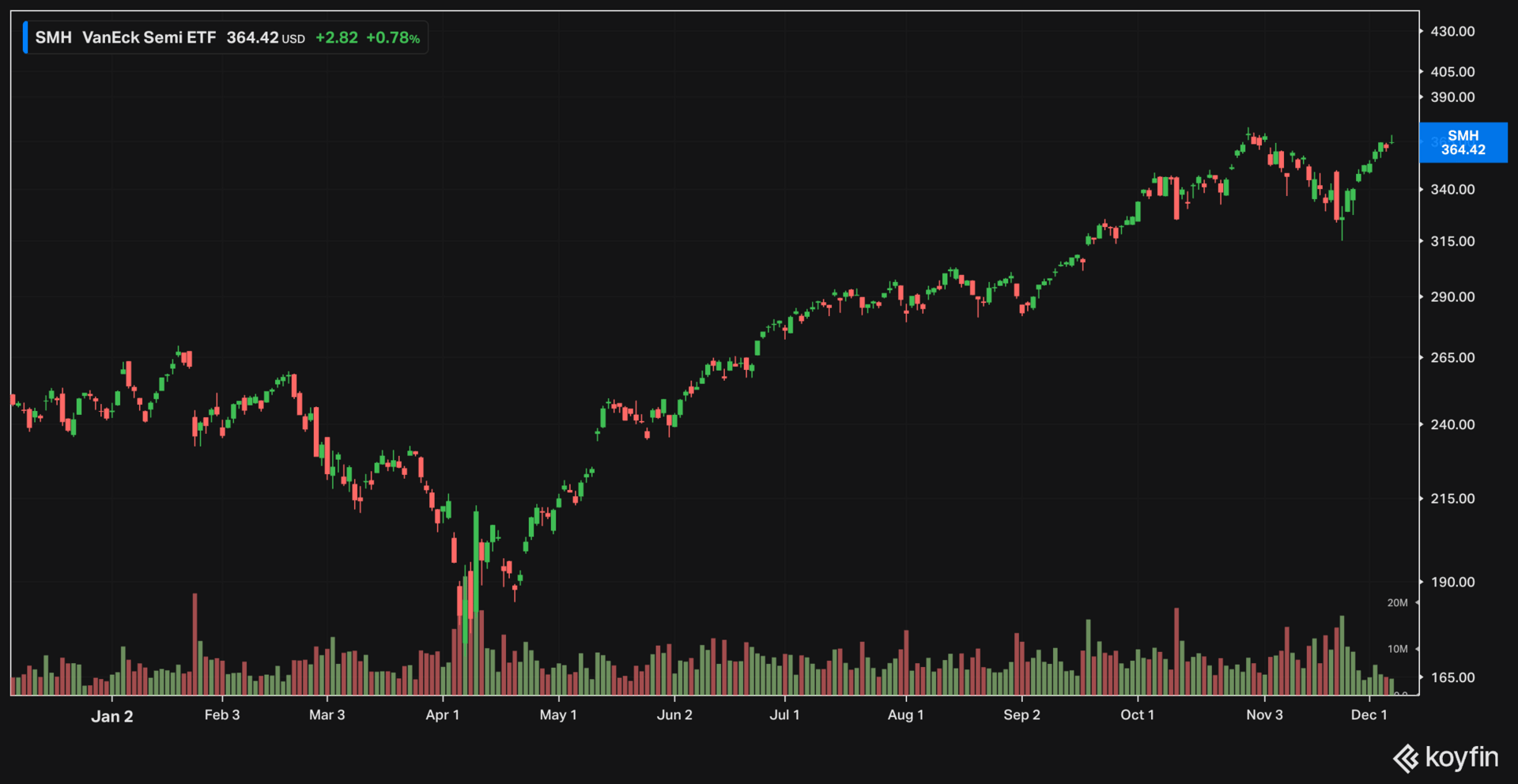

Tech Leaders, Trends, and Diversification

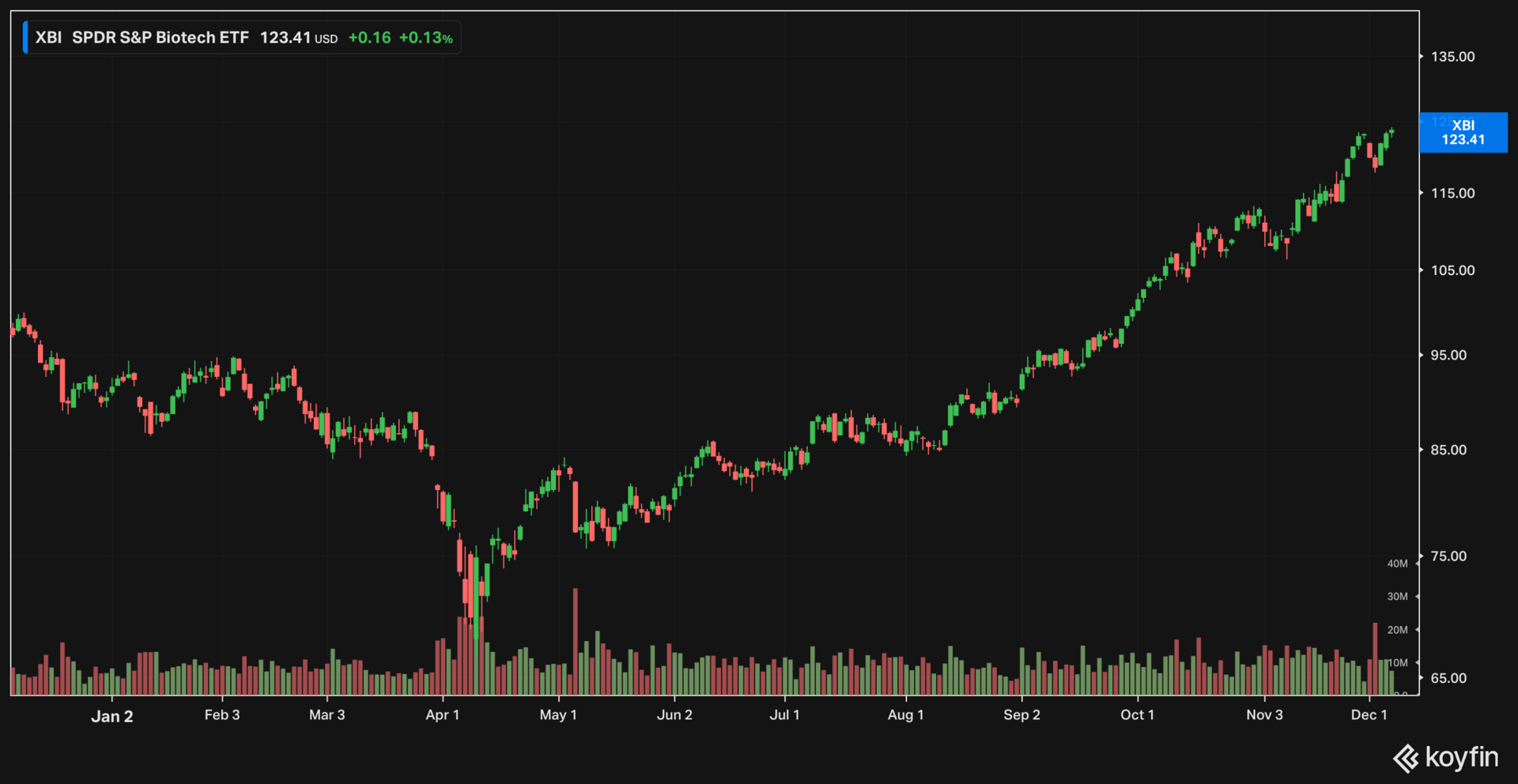

Speculation, Biotech, and Risk Appetite

Market Rotation, Rate Cuts & Wrap-Up

In This Episode, We Cover:

Here are Ivanhoff’s thoughts:

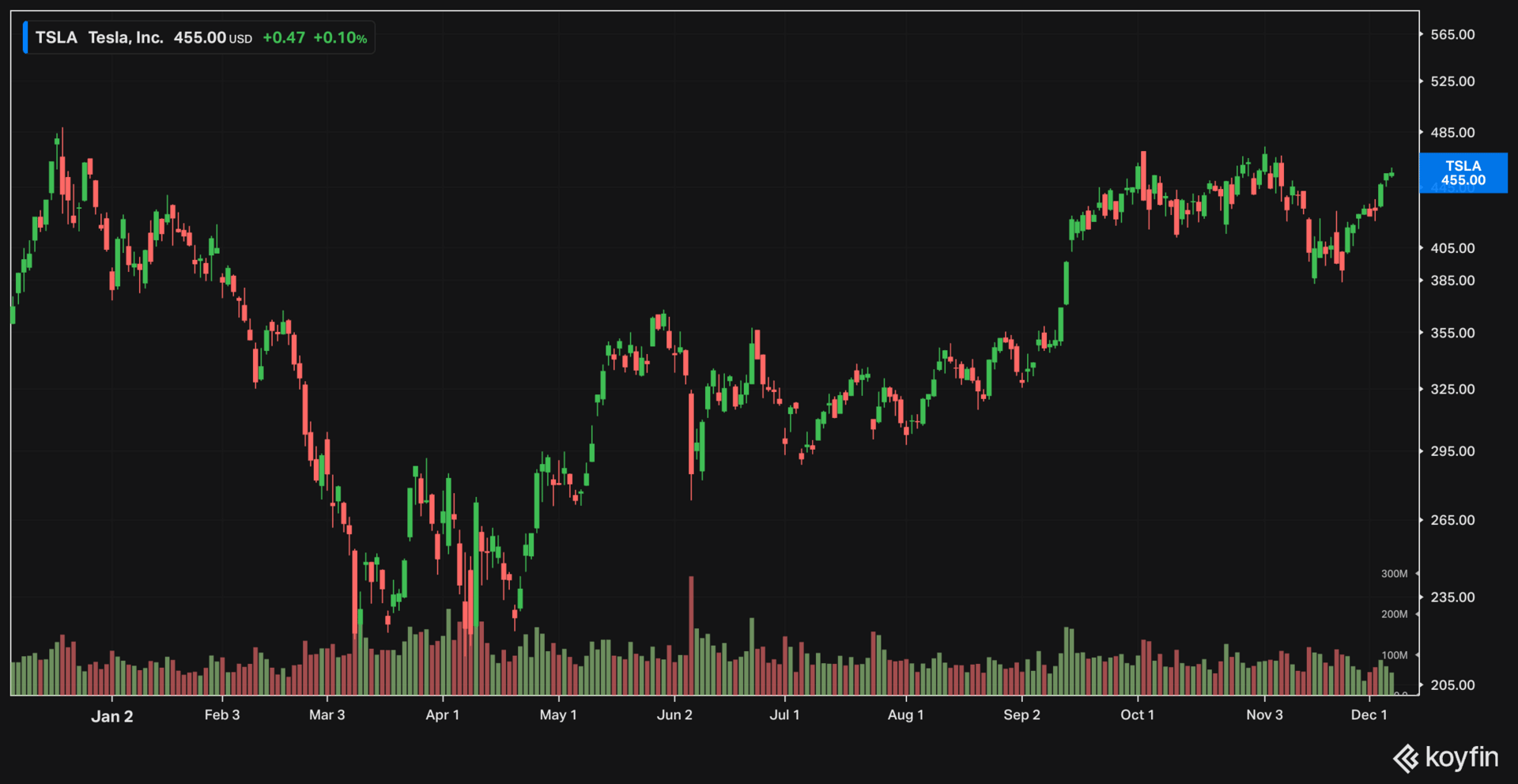

TSLA and PLTR are back above their 50-day moving average. NVDA is holding its rising 20-week moving average. Even META had a big bounce after announcing that they plan to slash expenses for their Metaverse initiative by 30%. Bitcoin and Ethereum also found some support and are potentially working on a higher low. The small-cap index is back near its 52-week highs. The dips were bought again. This is what happens in bull markets.

In the meantime, the highly-shorted speculative groups are bouncing back – you know the ones that doubled and tripled in September and then dropped 50% in October and November – nuclear, rare earth metals, quantum computing, space. The trouble with many of those stocks is that they are so starved for cash that they are using every little bounce to raise more money and dilute current shareholders. I view them strictly as short-term trading vehicles.

There’s an appetite for risk, but it might be tapered, at least temporarily, next week. The Fed will announce its latest decision on rates on December 10th. Previously, we would see a drop in rates ahead of a Fed meeting as the market anticipated a cut. The market is not so sure this time. Rates have been rallying. If there’s no cut this time, we might see a short-term pullback.

Reply