- Howie Town

- Posts

- Momentum Monday - Traders Chasing Commodities and Banks Still Quietly Thrive

Momentum Monday - Traders Chasing Commodities and Banks Still Quietly Thrive

As a reminder, MarketSurge (by Investor’s Business Daily) is a sponsor of the weekly show. All the charts you have been seeing in the videos and will continue to see are from MarketSurge. They are offering my readers 2 months for $59.95 - save $239. That's 80% off the most powerful stock research platform for individual investors.

Good morning…

We are in a seasonally good time for markets post Christmas and pre New Years, but I will say the $VIX is low at 14 for all the anger and bad behavior out there.

While Twitter turned itself into a crypto and technology bro stomping ground the last ten years, commodities and banks were neglected and forgotten.

Today, commodities and banks are leading the all-time high lists including Citibank/Shittybank ( $C ( ▼ 0.26% ) ), silver, gold, palladium, platinum and aluminum.

I never claim to know what happens next but a trend is a trend.

I open Twitter now and all I see are ‘I told you so’s’ so I imagine commodities will pause to refresh.

As for banks, it is the best of times (open up Max’s tweet and have a read) …

Ivanhoff and I tour the markets as usual looking for momentum and leadership and share a few new ideas as always. I hope you enjoy…

Welcome back to Momentum Monday!

In today’s episode of Momentum Monday, Ivanhoff and I discuss the following:

Billionaire Tax & Policy Concerns

Metals & Commodities Boom

Stock Market Trends & Tech History

Big Tech Moves & Corporate Battles

Banking, Crypto, and Small Caps

Retail, Global Stocks & New Year Wrap

In This Episode, We Cover:

Here are Ivanhoff’s thoughts:

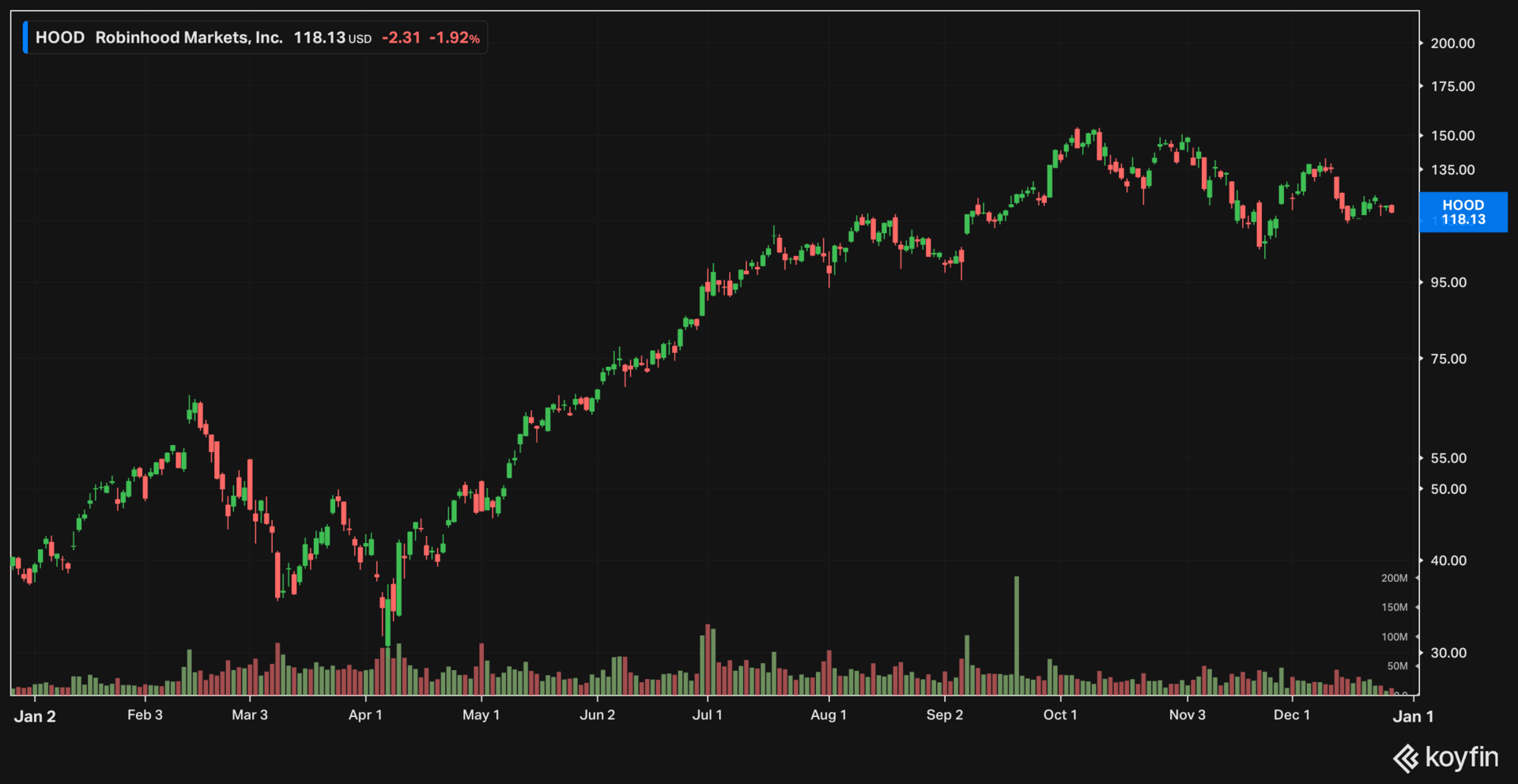

The main stock indexes started the year near all-time highs and are about to finish the year near all-time highs. A lot happened in between. The first quarter was marked by a big selloff in AI-related stocks, followed by a tariff war correction that hit the entire market. The Nasdaq 100 declined 26% in seven weeks. This ended up being the best buying opportunity since late 2022. The triple-leveraged Nasdaq 100 ETF, TQQQ, tripled from there. Stocks that showed relative strength during the pullback, like HOOD, PLTR, and NVDA, recovered quickly above their 50-day moving average and remained leaders for the rest of the year. The 2x leveraged Robinhood ETF, ROBN, went up almost 20x in seven months. This is why I like to say that the best entry opportunities often come after sizable market drops.

The bull market was back in full force by May. AI datacenter stocks like CRWV and quantum computing stocks like QBTS more than tripled in a few weeks. Crypto woke up for a brief moment. Ethereum doubled between July and mid-August. Then, gave up all of those gains in the rest of the year. Then came September, which became the hottest month for speculative momentum stocks. Everything doubled or tripled in a short period of time – quantum computing, rare earth metals, space-related stocks. Most of those short-term rocket moves round-tripped in October and November, but momentum didn’t leave the market. It simply found a new home – precious metals. Gold, silver, and platinum went parabolic.

As 2025 is coming to an end, the most frequent question I receive is about my predictions for the new year. What groups will be hot? I have no idea. I assume the same trends will persist in Q1. Memory chip stocks like SNDK went up 6x between September and November and barely pulled back, effectively building another base. This tells me they are being accumulated, so stocks like SNDK and MU might have more fuel left in the tank. Plenty of other stocks are acting constructively and setting up as well – SHOP, AMZN, BIDU, TSLA, NVDA, ALAB, RKT, etc.

Reply