- Howie Town

- Posts

- Momentum Monday - You Do Not Have To Like The Bull Market To Ride It

Momentum Monday - You Do Not Have To Like The Bull Market To Ride It

Price is the closest thing to truth in a market inundated with internet news and old people

As a reminder, MarketSurge (by Investor’s Business Daily) is now a sponsor of the weekly show. All the charts you have been seeing in the videos and will continue to see are from MarketSurge. They are offering my readers 2 months for $59.95 - save $239. That's 80% off the most powerful stock research platform for individual investors.

Good morning…

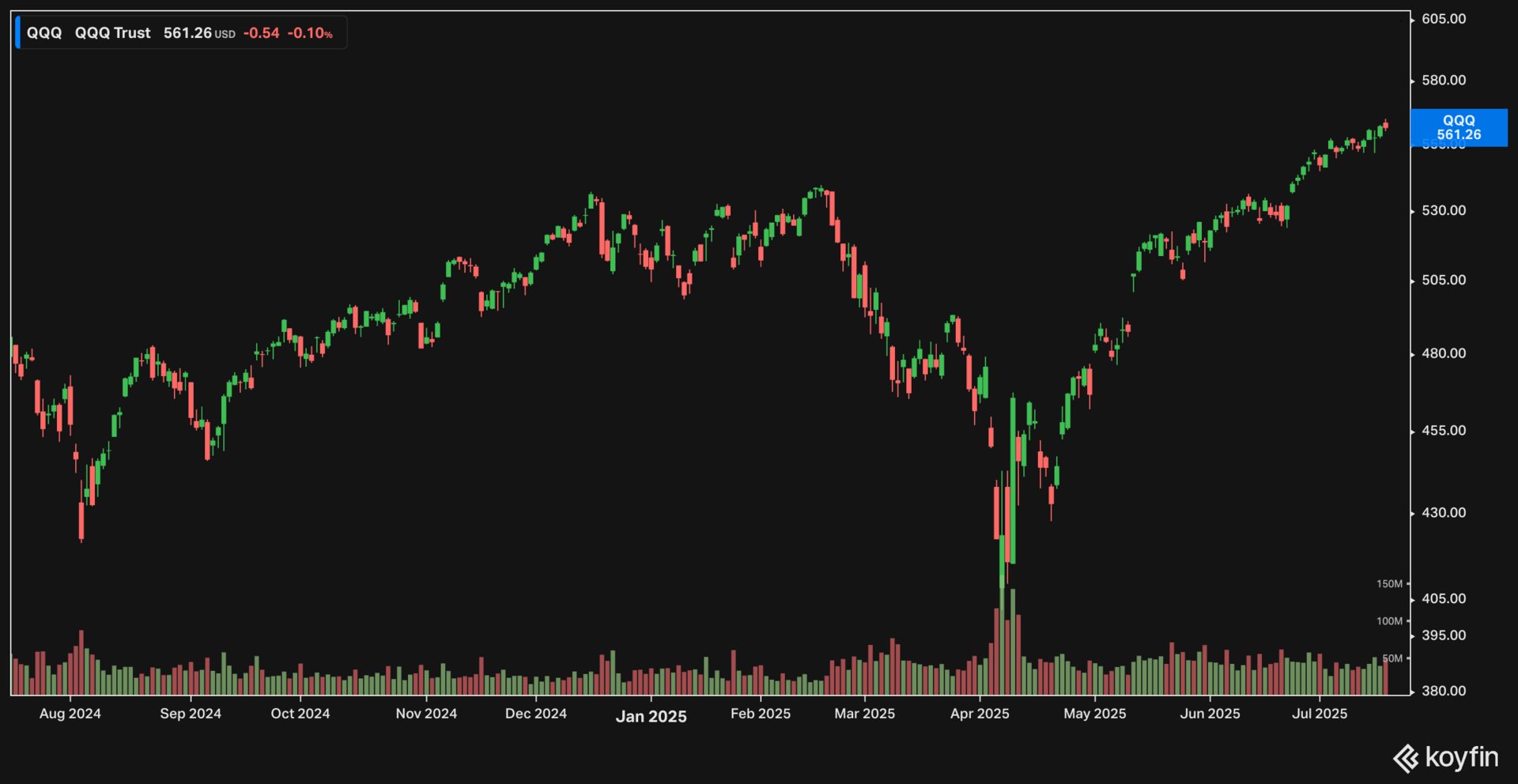

There is a lot to like about the price action and this bull market run.

If you are stuck on the ‘news’ and ‘fundamentals’ this bull market is a really hard one to grasp.

Who is MOST likely to be stuck on news and fundamentals…BOOMERS.

Comedian Ronnie Chieng has a great Instagram clip bit - not about investing - that sums up the opportunity for traders and investors that follow ‘price’ and the nightmare for those that believe everything they see on the internet - BOOMERS.

Riffing on Ronnie Chieng I would say:

‘Price is the closest thing to truth in a market flooded with internet news and old people’.

New is entertainment, mostly unhealthy and prices are for serious people.

For serious people that want to enjoy the market for the next 30 years, learn to follow price and the right people and build a money management system that fits your personal risk profile. For everything else there is indexing and direct indexing.

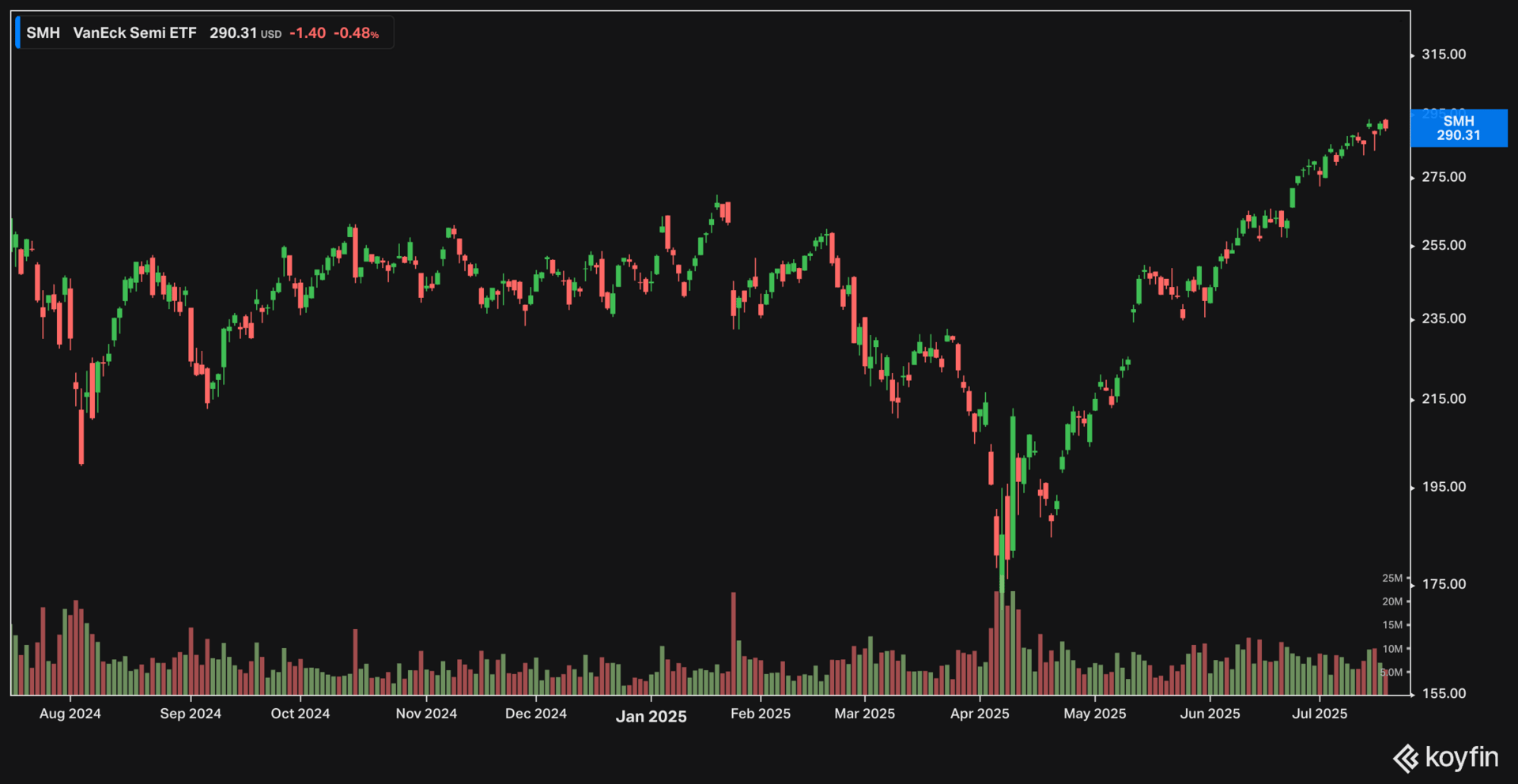

For the last 30 years, price has been my truth. It is not perfect of course, but it helps me size up the markets and how I think about risk and reward. Patterns repeat, the names change etc etc..

As always, Ivanhoff and I tour the markets and cover some ideas we have been sharing the last few months and some new ideas. Hope you enjoy

Please subscribe and share with your smart friends…

Welcome back to Momentum Monday!

In today’s episode of Momentum Monday, Ivanhoff and I discuss the following:

Current State of Crypto Investment

Investing in ETFs and Stocks for Peace of Mind

Bitcoin Launch by 2025: CEO Insights on CNBC

Understanding the Volatility of Tech Stocks

Trends in Space Exploration Stocks

Understanding Market Fluctuations and SPACs

In This Episode, We Cover:

Here are Ivanhoff’s thoughts:

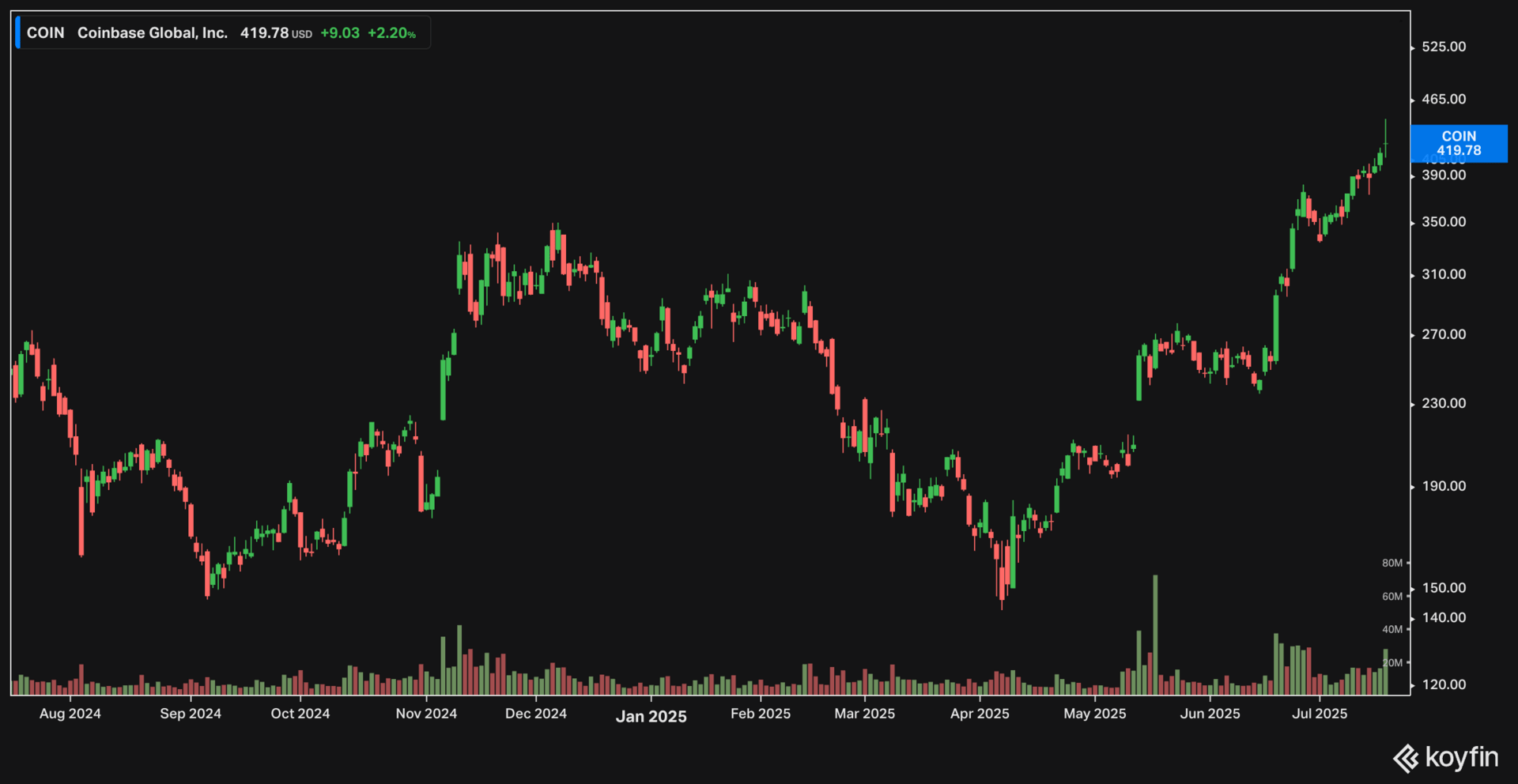

There are still plenty of opportunities in this market. Bitcoin hit new all-time highs. The 2x leveraged Bitcoin ETF, BITX, gained 25% in a few days. I participated in this move but missed on the much bigger moves in Ethereum and XRP. ETHU and XXRP went up more than 100% in a couple of weeks.

China has also awakened from its slumber. BABA JUL18 $110 Calls went from 1 to 12 inside a week, and we participated in part of the move.

The opportunities are everywhere: electric helicopters: JOBY, ACHR; drones: RCAT, KTOS, RDW; airspace: ASTS, RKLB; rare earth metals: MP, USAR; brokerages: HOOD, IBKR, BULL, FUTU, TIGR; uranium: LEU, OKLO, SMR; software: PLTR, TWLO, SOUN, AEVA; quantum computing: QBTS, RGTI; e-commerce: SHOP, SE; robotics: SERV, SYM, PDYN; crypto-related stocks: COIN, APLD, CRCL; batteries for electric vehicles: ENVX, QS; energy: NEXT, METC, SOC, etc.

There are certainly some elements of frothiness in the current market, but the bull remains strong. Many of the high-momentum flyers are likely to pull back in the next few weeks, but others will pop up and take their place. Bull markets correct through sector rotation.

Reply