- Howie Town

- Posts

- Sports Meet Finance...Finance Meets Sports - The TAM Explosion in The Degenerate Economy From Prediction Markets

Sports Meet Finance...Finance Meets Sports - The TAM Explosion in The Degenerate Economy From Prediction Markets

When the stock market closes the degenerate economy stays open

**Note: TAM = Total Addressable Market

What a difference a few years make in the ‘degenerate economy’!

In 2022, the mob wanted Vlad in jail for sprinkling ‘confetti’ on the screen after you executed a trade but in 2025 the mob is cheering Vlad and Robinhood on for offering sports and election bets.

Not only is betting offered, it is front and center.

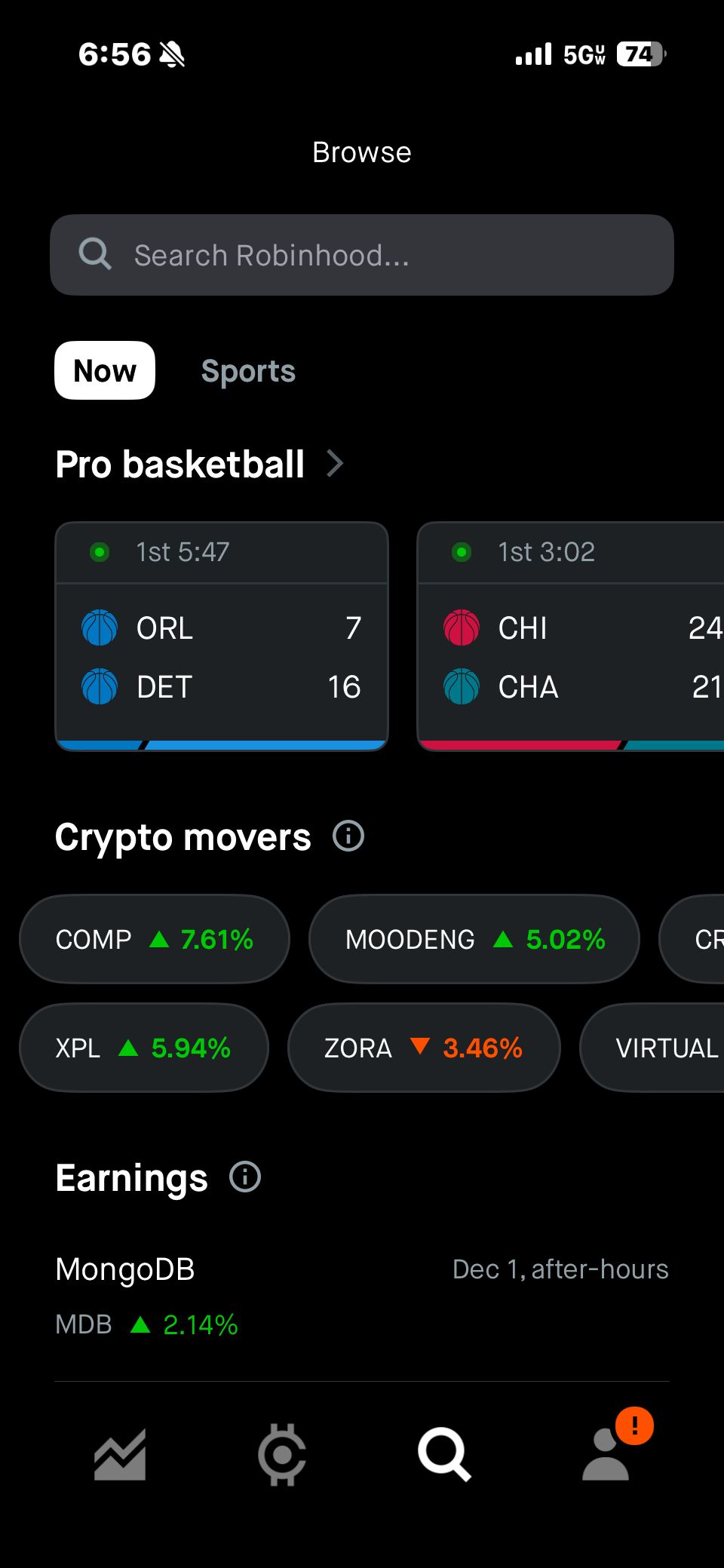

I opened up the Robinhood ( $HOOD ( ▼ 3.44% ) ) app the other night and when I went to search/browse I was given NBA scores (rare shoutout to myself for having a 74 percent charge)….

The stock market was closed but the ‘degenerate economy’ was open for business.

The morphing of sports, finance and markets is here. I did not see this coming but to deny it now would be ridiculous.

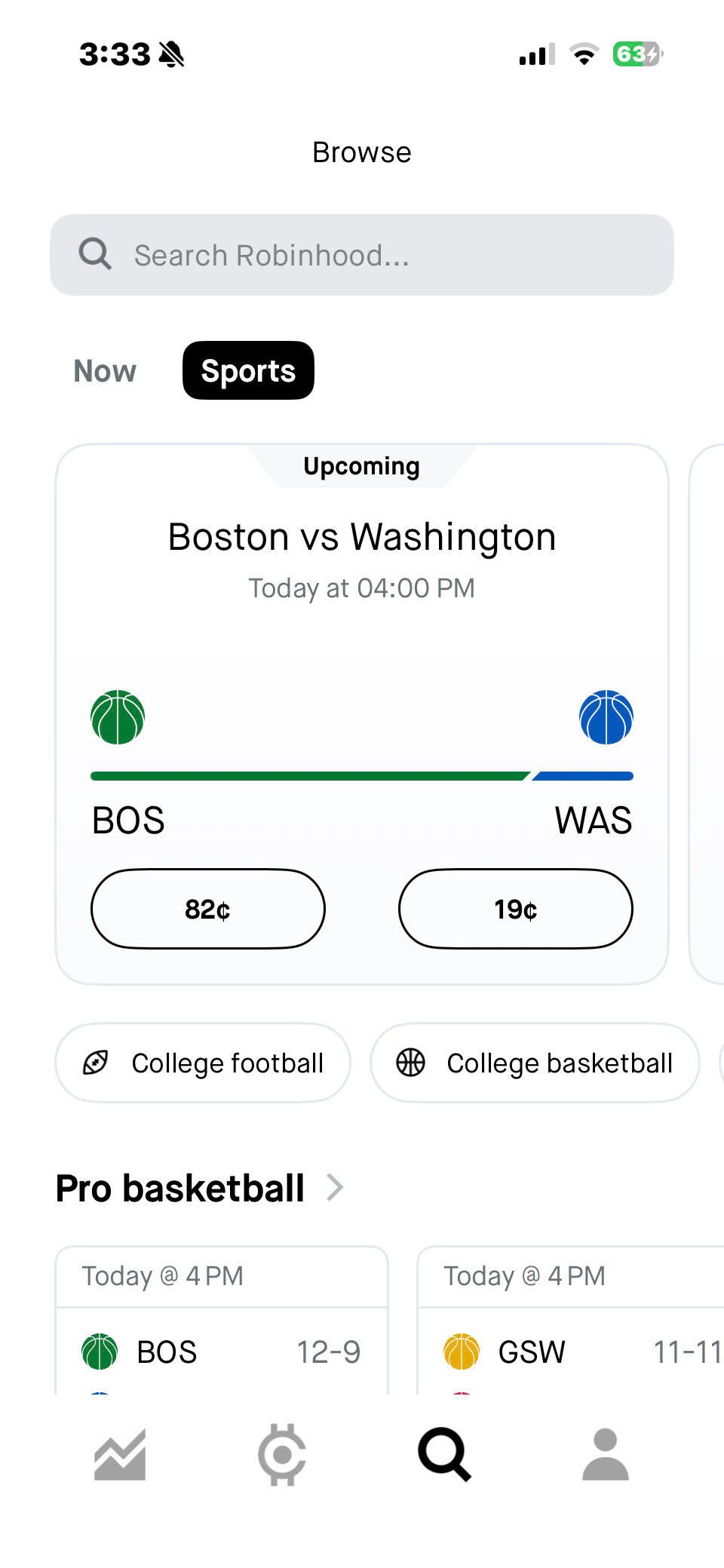

Robinhood does a great job of organizing this new way of looking at investing/betting by using a ‘NOW’ button and a ‘SPORTS’ button in search.

As you can see in the image below, during the day - specifically market hours - the background of the app is white not black and you have to select the ‘SPORTS’ button to get Sports bets.

For those that still do not know what prediction markets are, I liked this short easy read from Blake. Like Blake says below and I started to realize a few years back when I started the ‘degenerate economy index’, prediction markets are a paradigm shift…

Some criticize the increasingly blurred lines between investing and gambling and rightfully so.

And yet, humans have always bet on uncertainty – it’s hardwired into us.

The only difference today is technology like Polymarket has erased the boundary between “markets” and “bets” – good or bad.

Prediction markets are engraining themselves into the social fabric of the public consciousness as interest continues to mount. They strip away ideology and delusion. In its place, a platform that gives a voice to the people and provide signal.

Every trade becomes a datapoint. Every datapoint is a belief. And every belief gets priced instantaneously into the market.

This is a paradigm shift that will ripple out for many years to come.

Robinhood has been the purest public market way to own this trend. It has been in my degenerate economy index since day one as has Bitcoin, Coinbase, CBOE, CME and ICE (they invested $2 billion in Polymarket).

In the private markets it has been all Kalshi and Polymarket (I am a personal investor in Polymarket through an SPV). Both companies are now valued near $15 billion. I am cynical of these valuations, but I am always cynical of valuations. Not too long ago - in 2023 - Robinhood had $8 billion of cash and was valued at $8 billion. Today it is $120 billion. Nobody knows anything. Investors do not want to miss ‘the next Robinhood’.

While the world debates the AI bubble, the financialization of everything continues. Speculation as a hobby and entertainment is creating a new financial infrastructure.

I used to say the real ‘Superbowl’ happened every morning at 9:30 am EST when they rang the opening bell and ended at 4 PM with the closing bell. In 2025 there is no opening bell and no closing bell. There is a never ending string of events - large and small Superbowl’s happening 24/7/365.

As Blake says in the quote above… we are hardwired for this.

Reply