- Howie Town

- Posts

- Direct Indexing From FREC - Next Stop $1 Billion Under Management with New Products

Direct Indexing From FREC - Next Stop $1 Billion Under Management with New Products

The Degenerate Economy Will Diversify And Crave Tax Efficiency Too

Good morning…

We have one more portfolio company of ours is in the news this week.

Frec surpassed $600 million in assets under management with their direct indexing products. I had Mo on my podcast last year to explain direct indexing and introduce the company. You can have a listen here.

The company also launched two new products this week:

Diversify…Bring your concentrated stocks and we'll transition them into a diversified index for you with minimal tax impact.

and…

Long/Short Direct Indexing…High leverage options for Frec Long Short Direct Indexing

Since launching the 140/40 long short direct index, one of the most frequent requests has been greater leverage flexibility to further amplify market returns and tax savings. Now, investors can choose from:

140/40 with a value, quality, or growth tilt

200/100 with a quality or growth tilt

250/150 with a quality or growth tilt

These new options enable investors to increase return potential while significantly expanding tax-loss harvesting capacity. According to historical simulations, a 250/150 direct index tilted towards quality can produce 8.49% in after-tax excess return, and harvest up to 337% of the initial investment over 10 years2 .

Minimum investment for 200/100 and 250/150 long short strategies is $500k, and annual fees range from 1.00%-1.30%, plus 0.57%-0.86% in post-tax financing costs3 .

I am a customer of FREC and Social Leverage is an investor (fund 4).

Mo, the founder, is building the products and company for people/investors like himself. He sold his last company to Twitter. His mission and vision:

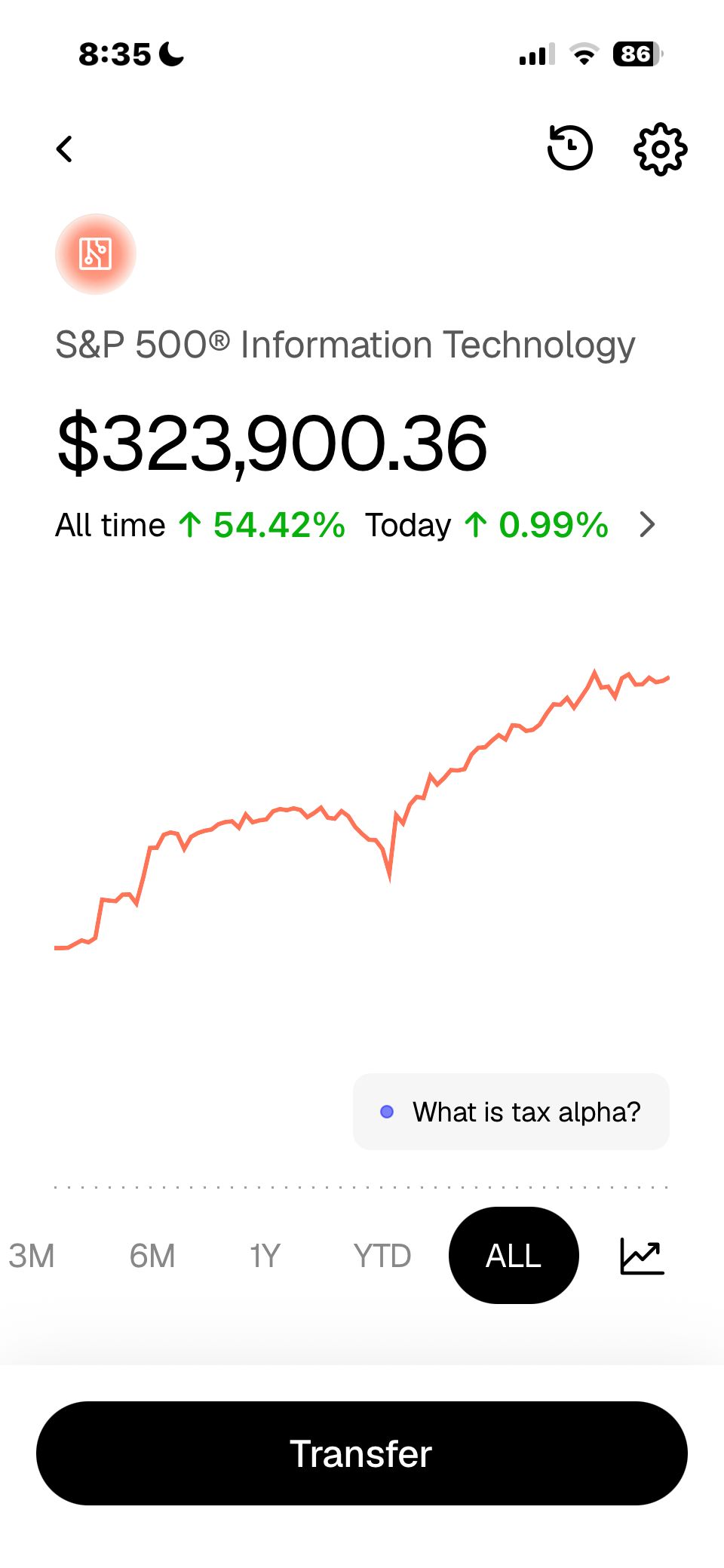

It is so easy to get started and the website and app are simple, elegant and easy to use. Here are screenshots from one of our family accounts that I hold S&P Information Technology ETF ( $XLK ( ▼ 1.6% ) - I added Google to this index because FREC allows you to personalize the index if you like by adding and removing stocks and change weightings) and the Van Eck Semiconductor Index ( $SMH - I have slowly lowered $NVDA percentage).

Hit me up if you have questions or want an intro to the team to get started investing yourself.

Reply