- Howie Town

- Posts

- There Goes Google ...and Amazon and Apple and Nvidia as AI Hype Rises...Is There an AI Bubble?

There Goes Google ...and Amazon and Apple and Nvidia as AI Hype Rises...Is There an AI Bubble?

Happy Sunday…

I am off to New York to work this week for work. I miss San Diego weather already.

Before I get started…wow that World Series was fantastic.

I remember where I was for Joe Carter’s homerun to secure back to back Toronto Blue Jays World Series in 1993 and I will now always remember where I was for many of the incredible moments from the Blue Jays/Dodgers World Series. I long ago stopped following baseball, but because of my old hometown Blue Jays making a run, Max and I got hooked. It was worth all the time we spent watching together, driving up to Los Angeles to watch game 4 with friends in the outfield to see the Jays win and of course texting with Max and friends last night as the Jays lost in a thriller.

My great nephew Wes in Toronto will remember where he was too…

By the way…my friend Om watched the whole World Series on his Apple Vision Pro 2 with the MLB app and said the experience was fantastic (he does live alone).

Onward…

The only sure things right now are death, taxes and an increase in the nauseating is AI a bubble discussions.

The one sure thing nobody is talking about right now is inflation. I consume a lot, I have kids, I travel and I like to eat out. I try not to think about prices because I am lucky enough to have savings, investments and high income, but holy shit it has to be terrifying for most people. I understand the yoots will pay $50 for a 'Doordashed’ burrito or Uber Eats pizza because they know they will never be able to afford a home, but I still worry for what the unintended consequences are of this under discussed topic at the moment.

But I digress… is there an AI bubble?

Gavin Baker is a go to for me on all things semiconductor and technology so best to listen to him on this subject in this great interview…

In the meantime, if you follow me here, you know that Google ( $GOOG ( ▼ 0.04% ) ) is my largest stock position. Before earnings I summed up as best I could right here on the newsletter. Google delivered.

Sam Altman of Chat GPT took hard to the podcast and press circuit this week in response to Google crushing it in AI and all else. This exchange below on Brad Gerstner’s podcast (watch the whole interview here on YouTube) went extra viral as Sam got defensive about the company and spending - right in front of Satya…

i’ll stick with long $goog

keep it simple

hard to short cringe and grift in 2025

— Howard Lindzon (@howardlindzon)

10:05 PM • Nov 1, 2025

Open AI faces a ‘Tsunami of COGS’ which is a new term I like…

If I am @sundarpichai, I will bury all competing foundational models in negative gross margin tokens for eternity.

I will NEVER take my foot off the pricing gas: to merely compete, I will force you to dilute your equity into oblivion.

Sam will drown in my tsunami of COGS. $GOOG

— Compound248 💰 (@compound248)

2:20 PM • Oct 6, 2025

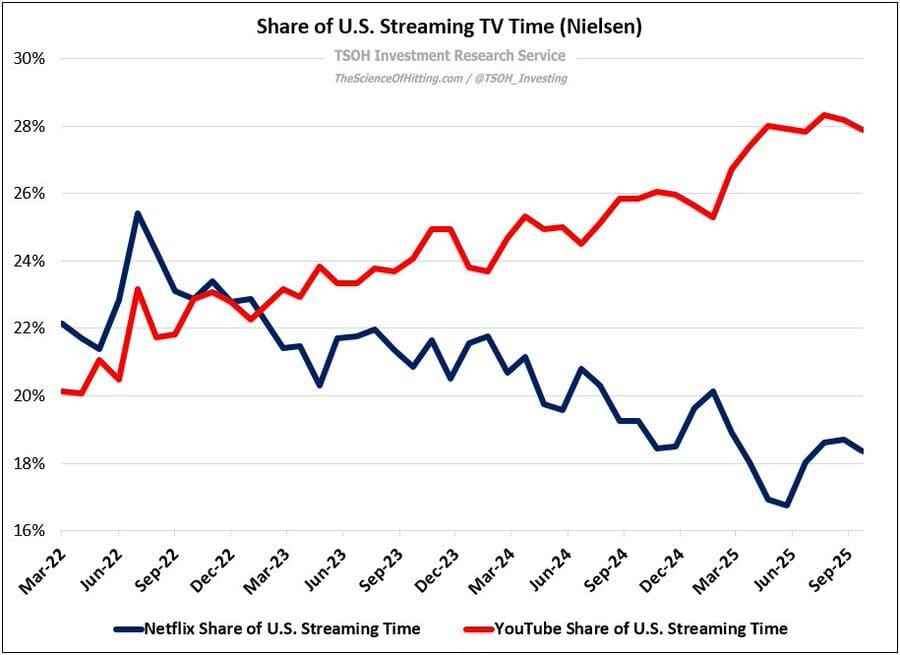

They face this ‘tsunami’ in the face of Google having so many better long-term advantages the biggest being YouTube, Gmail, Maps, Android and their TPU’s. Look at Google’s YouTube by the way…

Google, like the other Magnificent 7 making up 40 percent of the S&P is becoming asset heavier as this AI arms race continues so I did sell a few shares this week.

If Chat GPT was gone tomorrow, there would be some inconveniences but life would go on just fine. Same with Facebook. We would miss Whatsapp but figure things out. Not so with Google, Amazon, Nvidia, Microsoft, maybe even Tesla.

One way these companies will battle being asset heavier is with layoffs. I read this week that Amazon was laying off 10 percent of the workforce or 30,000 people. These companies my have hit peak hiring…

Amazon and Microsoft headcount

Increasingly confident we have seen peak Mag 7 employment

— BuccoCapital Bloke (@buccocapital)

8:16 PM • Nov 2, 2025

It was not just a great week for Google. Nvidia, Amazon and Apple also closed at all-time highs.

It’s not just inflation driving these stocks higher. These companies continue to grow topline, cash flow and earnings at an incredible rate despite the much talked about law of large numbers. Historically, these massive infrastructure buildouts like we are seeing in AI and have seen with railroads and the internet in the past have led to excess capacity and poor returns, so I am trying to be more selective when adding any new positions related to AI.

Haver a great week everyone.

Reply