- Howie Town

- Posts

- The Year 2026...Some Ideas and Predictions - AND This Week in The Degenerate Economy

The Year 2026...Some Ideas and Predictions - AND This Week in The Degenerate Economy

You do not have to like a bull market to ride it

Happy Sunday…

I am starting to think about 2026 as it relates to the markets and investing trends.

It is amazing how few things you have to get right to have a good investing year.

I know this because like every year I got so many things wrong and yet our household net worth grows.

Because I expect to get so many things wrong, I mostly index/direct index to make sure I stay invested. This year it was another good year for indexing which I do with $QQQ and my degenerate economy index. It helped that Google came to life in the last quarter.

It also helped that I was a buyer of $VIX 60 in April. On April 6th, I outlined what I was doing. ‘If you buy the indexes this week and walk away you SHOULD be happy’.

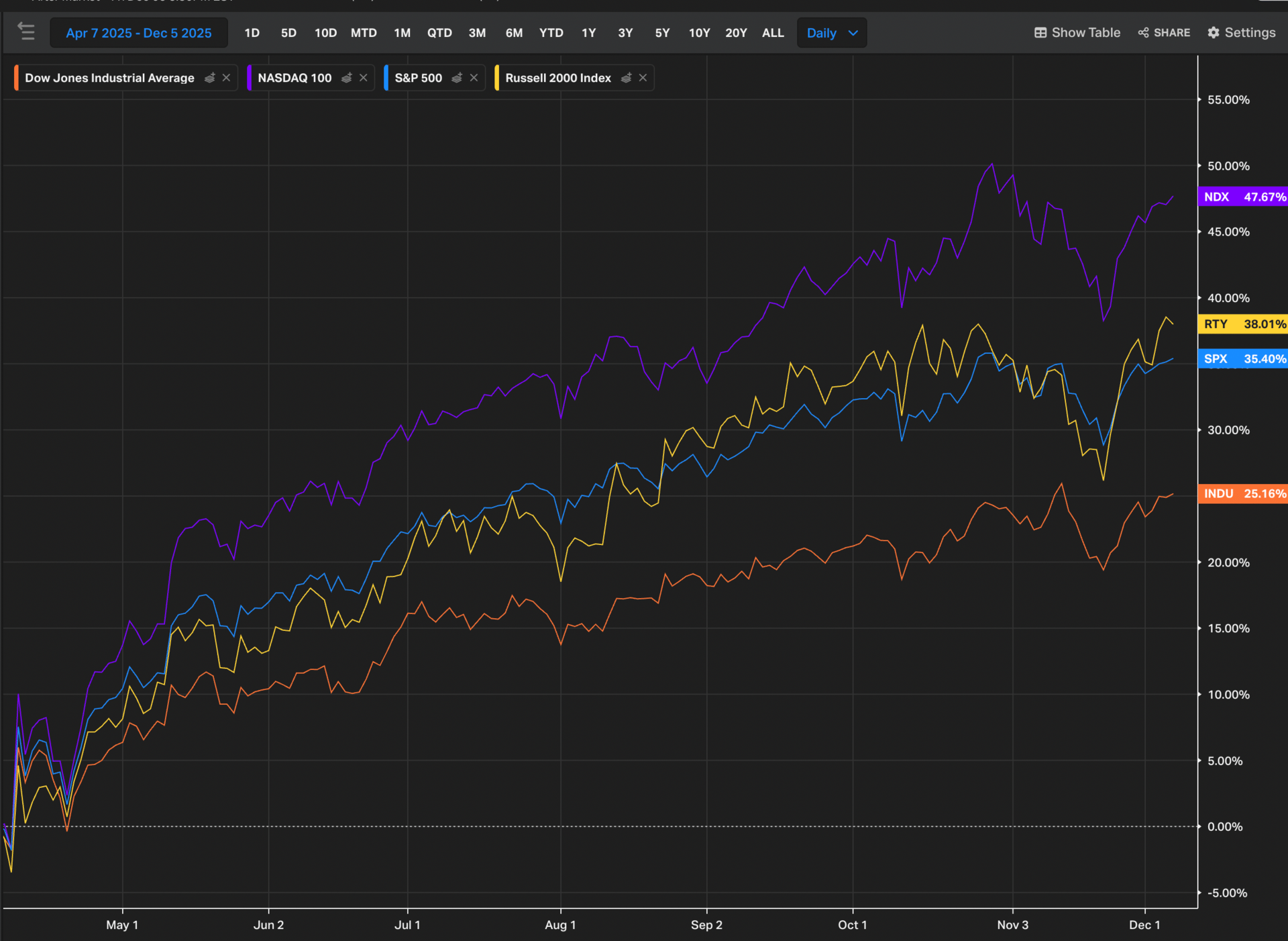

Here are the index returns from April 6th to Friday…not too shabby:

I looked back at my March and April posts just to see how I was thinking and it was a great reminder why the most important thing I do to be a better investor is to consistently journal.

Buying a panic is not comfortable because every panic ‘feels’ different. I called this one ‘the dumbest bear market in history’. It was really so dumb and Trump is so mean, and negligent that it felt awful to trust the data. Thank goodness I did.

In July I wrote ‘you do not have to like the bull market to ride it’. That is my anthem going into 2026 as well. Price is the closest thing to truth in a market inundated with internet news and old people!

So what about 2026 because that is what I promised in the title…?

In a world where the only ‘real time’ is Trump’s iPhone and what he posts on his own platform, we are all the suckers in the room. If you think you have an edge it’s because you are standing next to Trump or part of the conversation before he ‘truths’. I want no part of ‘real time’. The pipes are owned by Trump, China, Zuck and Elon. I call this era a ‘post real time world’ and I think that if you embrace that and invest accordingly you can still beat the markets, keep your sanity and save your soul.

Prediction markets are a brand new wild west real time platform. There are NO rules of engagement and I assume everything is rigged. What predictions markets do is open up and decentralize distribute inside information to a wider group of ‘insiders’ - which I think is rather cool and interesting and inevitable - but I want even LESS to do with them for now because of that. They are a toy and I am super respectful and curious of their new power and influence.

So now you know what I am NOT doing.

Here is what I am doing…

Top down I liked this piece from Larry on ‘market breadth’. I read Larry regularly because I trust his consistent work and it saves me hours. If you trust me, best work Larry into your reading. Other than ‘price’, market breadth is something I trust and with people like Larry doing this for me, I can make better decisions.

I am going to wait for the fat pitches because we will get another March 2025 like event because we get one every year and every year you wish you were better prepared.

I am looking at the small cap index ( $IWM ( ▼ 1.85% ) ) and the Nasdaq 101-200 largest market cap stocks the $QQQJ ( ▼ 1.07% ) ( the junior $QQQ ( ▲ 0.32% ) ). If the smaller companies do well, I am ok with the coverage these indexes would provide. Both these indexes are breaking out.

On the product/geek/living in the future front, one thing I plan to do is get what Fred Wilson calls a ‘crypto burner phone’ from Google Android. This feels like the future of money and communication for the world in the way self/autonomous driving is for transportation.

For Stocktwits and my own fun, I am very intrigued by the innovation and edges in and around prediction markets. I believe prediction markets, crypto, crypto wallets and stablecoins pave the way for peer to peer betting which is pretty darn degenerate, but something I want to be able to do with my different networks tight and loose. I think the game within the game of predictions and betting, lightweight, small bet, bragging rights type games is a massive market.

Finally…

In this week’s episode, I cover the following topics:

Robinhood has acquired its way into a leadership position of prediction markets as Kalshi and Polymarket battle for distrubution. I discuss why this shift matters, how the business models will evolve, why Robinhood has the advantage, and why companies with existing audiences are in the best position to win.

Finally, I break down the impact on valuations, the absolute TAM for prediction markets (which is exploding), and why the degenerate economy theme is spreading faster than ever. Another enormous week in the world of degeneracy.

You can follow along with how I have been investing along this theme the last few years with the index I created here.

Hear Ye, Hear Ye (0:00)

Degenerate Index Update (0:34)

Apple & Google at the Edge (1:14)

Adding Amazon (1:44)

Robinhood Builds a Prediction Market (2:19)

Sports Scores in Robinhood (3:01)

Sports + Finance Merge (3:45)

Kalshi & Polymarket Scramble (4:03)

Prediction Markets = Media (4:41)

Partnership Land Grab (5:39)

Who Actually Wins (6:02)

Valuations Under Pressure (6:26)

Endless TAM for Predictions (7:43)

Wrap-Up (8:22)

Reply